Delivering Proven Digital Solutions for Credit Unions

Today’s credit union member expects service providers to deliver on their terms – communicating seamlessly through digital touchpoints across multiple channels as part of a tailored customer experience. CustomerMinds has been working with Credit Unions for more than five years to help digitise and optimise the Member Experience. Our secure, cloud based platform can support digital journeys through Member Acquisition, Onboarding, Servicing & Retention. Our specialised understanding of the credit union space has allowed us to create an optimised customer experience solution for Credit Unions. We have supported this by developing a specific Credit Union Starter Bundle that delivers a unified ‘out-of-the-box’ customer journey framework to get you up and running as quickly as possible.

Why do Credit Unions choose Which50?

Our focus is on delivering operational efficiencies to Credit Unions and helping them create exceptional digital member experiences. From marketing automation to digital onboarding solutions and bespoke customer journeys, CustomerMinds has all the tools credit unions need to enhance the experience of your member base, ensuring your well placed to acquire and retain customers. You’ll be in safe digital hands with CustomerMinds and our Which50 platform.

-

Reason 1

By focusing on a digital-first approach, we can help you minimise and possibly eliminate member correspondence on paper. This will reduce cost and optimise resources for back-end teams.

-

Reason 2

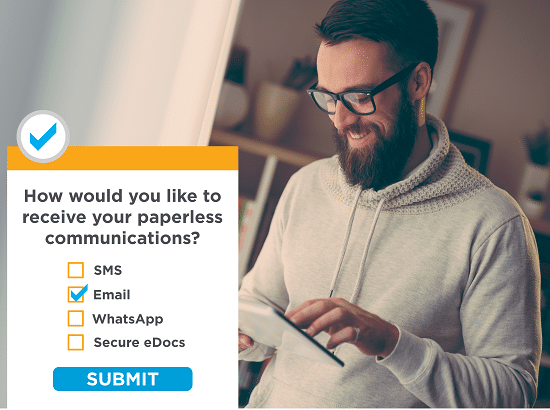

Two-way communication with credit union members is enhanced using their preferred communication channels.

-

Reason 3

Rich data and feedback from members can be used to craft future communications and targeting for credit unions.

Benefits for Credit Unions

Our cloud-based platform has a range of features developed with the Credit Union sector in mind.

-

Save time and money

By replacing traditional postal letters with digital versions, Which50 allows you save time and money by reducing your ‘Cost to Serve’ while delivering a better member experience.

-

Enhance security

You can securely provide paperless options for delivering statements and other documents containing your members’ personal and financial information. Two-factor authentication allows your members access secure files online with a unique SMS code.

-

Help vulnerable members

Accurately identify and engage with vulnerable members by creating bespoke member journeys. You can offer alternative methods of payment to financially at-risk members and provide them with opportunities for two-way communication.

-

Tailor application journeys

End-to-end loan application journeys can be designed leveraging dynamic web pages with two-way communication via relevant digital touchpoints including Email, SMS and WhatsApp messaging. This enables members to apply for a loan whenever and wherever they want by creating these highly customised journeys.

-

Automate onboarding

You can easily automate personalised welcome journeys for new members. This allows you engage new members by creating personal communications at scale across digital channels.

-

Convert new leads

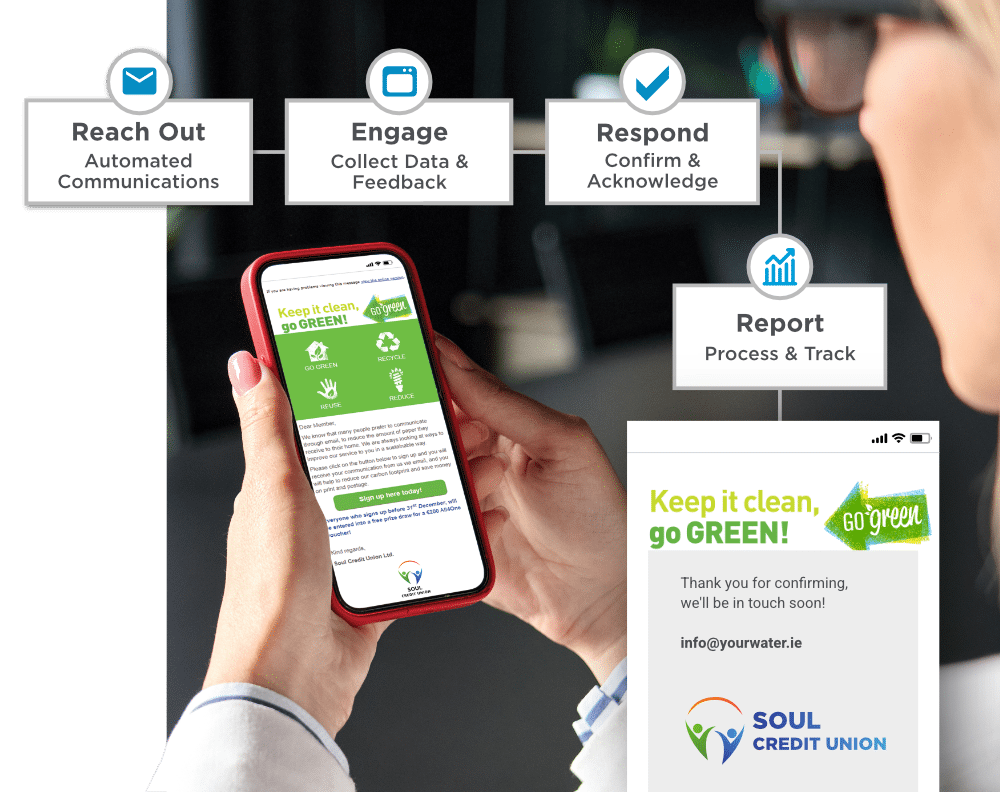

By seamlessly capturing and converting new leads across digital channels, you’ll be able to easily convert prospects through data capture forms online that trigger automated follow-up communication.

Interested in an agile, quick and easy way to engage your members today?

Discover the 4 comprehensive digital member engagement journeys of our Credit Union Starter Bundle, designed to empower your credit union and enhance your members experience.

1. Consent Collection

Which50 gives you the tools and reporting capabilities to support all of your GDPR compliance requirements. The ‘built in’ Consent Management features allow your members to easily update and edit their consent and communications preferences online. Our Compliance Portal provides staff with a centralised view of all the member consent details and has been purpose built to support all of the regulatory and reporting requirements of the GDPR.

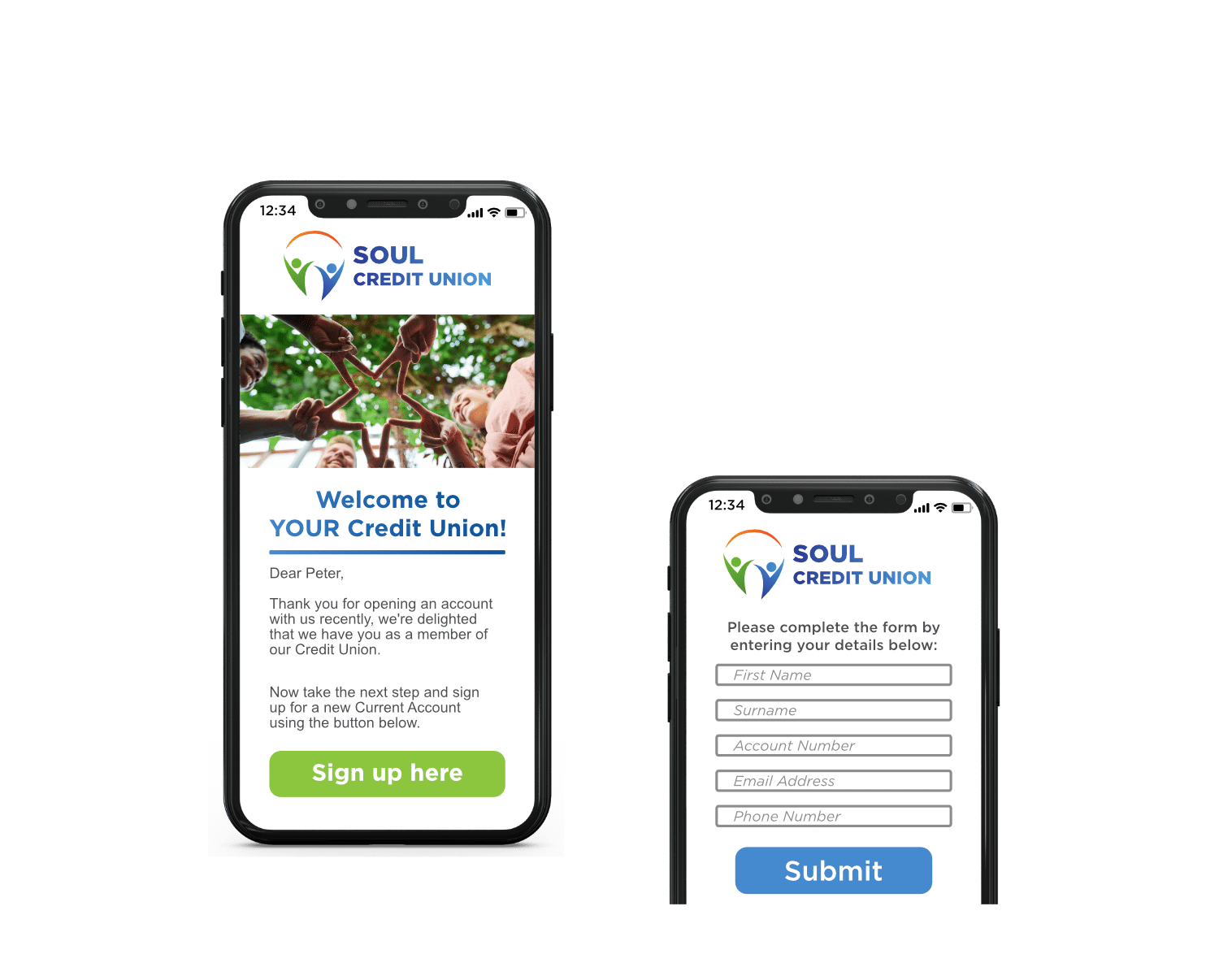

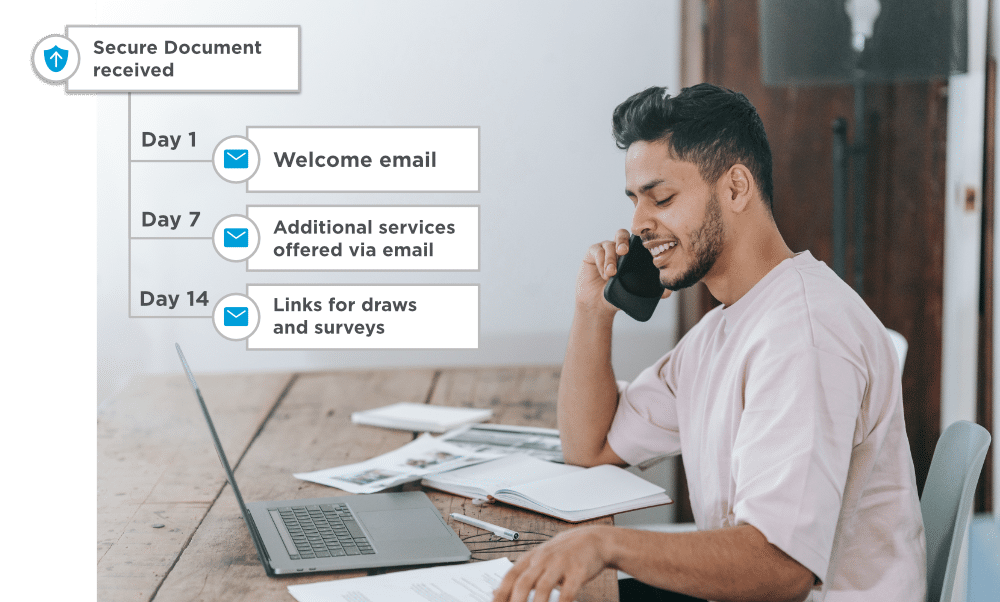

2. Welcome Journey

An automated Welcome Journey can save your Credit Union time, money and hassle on a daily basis. After signing up a new member, Which50 can automatically schedule and activate your Welcome Journeys. This can include emails that will be delivered on a predetermined schedule of your choice, maybe after 7-days, 14-days, or one-month. Automated follow-ups like this can nudge members to certain services you provide, such as your online account management or e-statements if they have not already signed up.

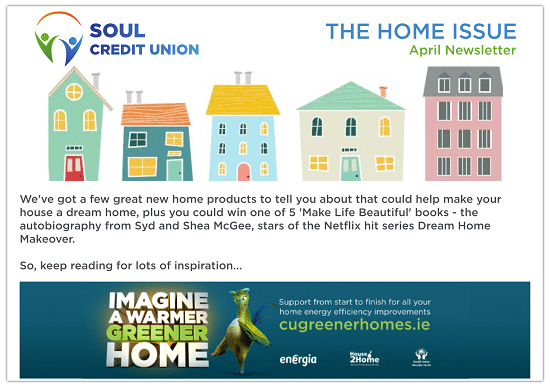

3. Newsletter Template

The newsletter email template will be designed around your Credit Union’s existing branding and will be set up to promote a range of products and offers in each edition. Links for each marketing promotion can be included in the email which can be used to bring members back to your website or to specially designed webforms or surveys that have also been created in Which50.

4. Letter Replacement

Which50 can replace traditional letters with digital communications, making life easier for members and ensuring your operational costs are kept under control.

Credit Unions can replace legacy communication methods such as letters and phone calls with engaging and trackable digital touchpoints as part of carefully orchestrated customer journeys. The environmental benefits of removing large volumes of paper will contribute towards your ESG objectives. Our engaging and effective digital communications solutions are proven to enhance member experience and reduce churn.

Learn how CustomerMinds can help optimise your digital member journeys with our Credit Union Starter Bundle

With clients around Ireland and the UK, CustomerMinds is a specialist provider to credit unions when it comes to marketing automation and customer communication solutions. We are pleased to share what some of these credit unions have to say about our platform and service:

LOG IN

LOG IN