A Welcome to Life with CustomerMinds

The name Life Credit Union may be quite new, but they have actually been around since 1968, so their financial expertise has been built over more than 50 years. From a humble beginning in one room in Naas Town Hall, they have gone from strength to strength, now offering their members 24/7 service through their digital and online offering and face-to-face opportunities through a network of 4 branches across Naas, Monread, Newbridge and Maynooth.

Life Credit Union was in need of a platform that would deliver an engaging and informative series of welcome emails at the beginning of their customer journey immediately after a member signs up. Not only this but it was necessary that they were provided the means to make consistent follow up communications with their clients. This was an ideal opportunity for CustomerMinds to showcase how the marketing automation capabilities of the Which50 platform can benefit credit unions by implementing a bespoke customer journey for new customer onboarding.

Business Challenge

“The challenge for Life CU was to deliver an engaging and informative series of welcome emails immediately after a member signs up. There is so much that Life CU offers and we wanted a way to let new members know about all of the key services and products, and to be able to quickly sign up or find out information about them e.g. Current Account, Online Banking & App, Nominations etc.”

-Julie Thornton, Head of Marketing at Life CU

The Solution

In order for Life to be able to optimise customer communications, they needed a platform that would provide a fully digitised experience at every stage of their journey, lowering costs, increasing internal efficiencies and enhancing compliance.

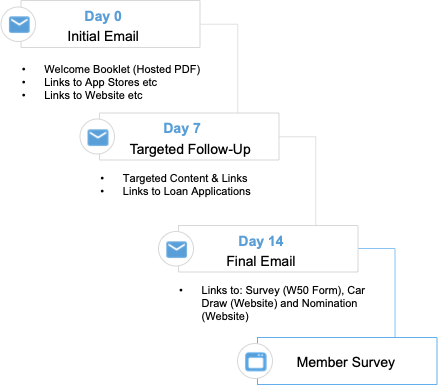

Using the Which50 platform, CustomerMinds created a Welcome Journey consisting of 3 Emails that are sent to new members over their first two weeks. A file containing the details of new members is loaded once a week while everything else in the process is automated – drastically reducing the workload for marketing and operations personnel at the credit union. Each email contains important information for new members as well as links to register for Online Banking, to download the Mobile App and more.

Welcome Journey Flow

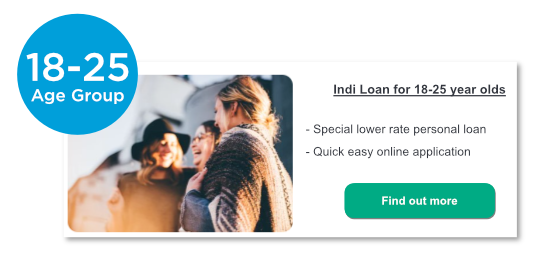

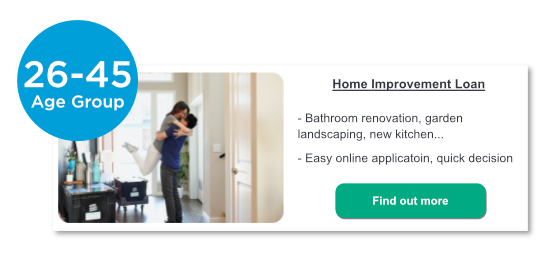

Different versions of each email have been designed to ‘target’ different member age groups ranging from ages 18 – 25 years old to 65 and over. Different content and options are presented to members based on what is likely to be most relevant to them at each ‘life stage’. Different visuals and messaging are used to target the specific age groups. Varied ‘Call To Actions’ are included that encourage members to click through to relevant products and offers. This Target Segmentation can be easily set up in Which50 with just a few clicks of the mouse and with no code required! The Which50 platform provides Performance Statistics to help to measure how each campaign is performing on an ongoing basis. Data from all channels is available in one place which supports testing and evaluation of campaigns in real time. Performance Statistics provide detailed analysis of each link in an email clearly showing what members value the most.

The Results

- Over 11,500 emails have been sent to new members so far.

- These emails have had an average read rate of 77%, average Click Through Rate(CTR) of 16%. In financial services, the average CTR is 6.8%.

- We are now able to track average read rate and Click Through Rate via individual links, enabling us to see what members are interested in.

- Delivering targeted content relevant to new members helps create engagement and loyalty.

Key Takeaways

- Significant budget has been saved on the printing of digital packs.

- CustomerMinds has enabled fast communication with new members, including those who onboard digitally.

- The Which50 platform is providing rich data and feedback from members that can be used to craft future communications.

- Changes and updates can easily be made to accommodate new products/services e.g. Peopl Insurance

If you would like to learn more about how we can help you, please reach out to us below and we will get back to you as soon as we can.

LOG IN

LOG IN