Shifting to a more Sustainable Future – St. Canice’s Credit Union

With over 65,000 members, St. Canice’s Credit Union is one of the largest community based credit unions in Ireland. Following a series of mergers, it now serves members in the wider geographic common bond areas of Kilkenny, Carlow, Laois and Tipperary. As well as contributing to the financial health of members through savings and loans, it also supports a huge range of community organisations and events.

St. Canice’s Credit Union’s journey with CustomerMinds began back in March 2018 and since then they have been shifting to a leaner and greener future by digitising more and more of their member communications. For the first couple of years they relied on the team at CustomerMinds to prepare and execute their credit union marketing automation and customer communication campaigns but in early 2022 they decided that they wanted to switch to ‘self-service’ so that they could have more input and control over their member communications.

The credit union sector has been appointed by Minister Eamon Ryan as Sustainable Development Goal (SDG) champions for 2023 and 2024 highlighting the critical role that Credit Unions play in communities nationwide. The SDG Champions Programme was developed to raise public awareness of sustainability and to demonstrate that everyone in society can make a contribution to the UN 2030 Agenda for Sustainable Development.

Key Challenges

- Environmental Impact: To support their green agenda by significantly reducing the amount of paper used from member communications.

- Member Engagement : To deliver a personalised member experience across marketing, operational and service communications.

- Cost Management: To reduce the paper and postage costs for large mailings such as the AGM notification with the Annual Report.

- Compliance Standards: Ensure that all communications are compliant with all regulatory requirements including GDPR.

The Solution

To switch to ‘self-service’ a small number of the team in St. Canice’s Credit Union were identified as the key users of the Which50 platform and they underwent a number of online training sessions. The team at CustomerMinds had already set up a number of templates that could be easily re-used for different communications and it didn’t take long for this training to pay dividends with St. Canice’s Credit Union quickly gaining the capability to design and deliver their own campaigns for both marketing and operational purposes.

The Which50 platform aligns seamlessly with the values and goals of the credit union sector and its intuitive and user-friendly interface helped the team to engage effortlessly with their member audience, facilitating transparent and real-time interactions. This digital transformation allowed St. Canice’s Credit Union to foster stronger relationships with their members while enhancing their overall experience.

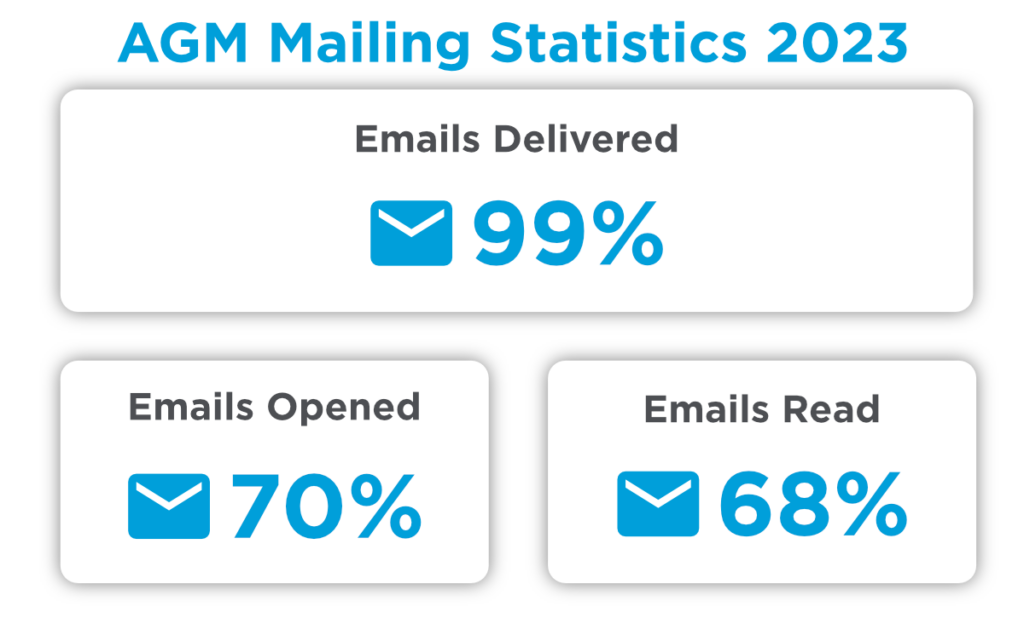

As an example, in January 2023 the AGM notice and pack were sent out digitally to over 20% of the credit union’s members using the Which50 platform. Leveraging the platform’s efficient email distribution system, St. Canice’s Credit Union sent out AGM notices well in advance of the meeting and the tracking and reporting capabilities of the platform meant that they were able to identify members who would not have received the email due to technical issues or incorrect contact information which was critical from a regulatory perspective.

The Results

Since starting with CustomerMinds in 2018 St. Canice’s Credit Union has issued over 450,000 digital communications to their members and since April 2022 over 175,000 of these messages were issued on a ‘self-service’ basis. If each of these communications had required €1 for postage it is easy to calculate the significant cost savings achieved which allowed the credit union to redirect resources towards further improving their services and delivering greater value to their members.

Transitioning from traditional paper-based communication to a digitised member engagement platform has also been instrumental in reducing St. Canice’s Credit Union’s environmental footprint. At the heart of the green initiative is a dedication to promoting environmental stewardship and reducing unnecessary waste which is a key goal for both the credit union and its members. By adopting the Which50 platform, the credit union has not only embraced modern and efficient communication methods but also contributed to reducing paper consumption, lessening reliance on natural resources, and lowering carbon emissions.

Key Takeaways

- Significant budget saved on traditional printing and postage costs.

- Which50 has allowed St. Canice’s Credit Union to reduce their environmental footprint.

- Transition to ‘self-service’ delivery has supported an agile and engaging communication process with members.

- CustomerMinds training and support makes using the Which50 platform quick and easy for marketing teams.

- The Which50 platform provides rich data and feedback from members that can be used to craft future communications.

- Changes and updates can easily be made to accommodate new products/services.

Testimonial

If you would like to learn more about how we can help you, sign up below to our monthly Which50 Works Credit Union Newsletter.

LOG IN

LOG IN