Mutual Interests: Digital Strategies for Deepening Member Relationships

We recently published an article based on the premise that the key to mastering customer retention was to deploy a proactive strategy rather than relying on reactive measures that may be a bit ‘too-little-too-late’ to stem the flow of departing customers. That proactive “whole customer journey” approach is applicable across many industries but in examining the banking sector more closely, it is increasingly evident that this progressive, digital-first outlook actively supports the trusted, personal ties that have differentiated mutual banks for over 200 years.

As Coventry Building Society prepare to acquire and remutualise Co-Operative Bank, the success and prominence of member-owned banks once again returns to the media spotlight. This potential deal is not a new phenomenon either with Nationwide acquiring Virgin Money in the UK, G&C and Unity Bank and Bank Australia & Qudos Bank mergers in Australia among a growing list of merger and acquisition activity in the mutual banking sector illustrating the increasing strength of community-owned banks in recent years.

The acquisition of Virgin Money by Nationwide has been seen by analysts as a new era for mutuals’ challenge to big banks while a 2023 report from KPMG suggested that Australian mutuals have outperformed the broader banking sector. Against this prosperous backdrop, we explore five ways in which digital technology can enhance customer relationships and bolster customer retention in these member-centric institutions.

1. Preserving Personalisation As A Differentiator

Historically, mutual savings banks provided a local, trustworthy alternative for working class individuals to store money securely and earn interest. Personalisation has been a persistent differentiator and this can be preserved through technology.

While conventional banks focus on the efficiency benefits of technology, evidenced by a reduction in personnel and physical branch closures, mutual banks have a different outlook with technology instead acting as a scalable extension of the personalised, familiar service that members value.

“Digital first, human always” is how this has been described by Coventry Building Society’s Head of Finance Transformation, Andrea Harrison. While CBS are amongst the largest building societies in the UK, the benefits of technology are available to mutual banks of all sizes and budgets. Leveraging customer data can help to enrich offerings and tailor unique solutions such as customised financial advice along with predictive services anticipating emerging customer needs.

For example, different visuals and messaging can be used to target specific age groups with varied ‘Call To Actions’ included that encourage members to click through to relevant products and offers. This kind of Target Segmentation can be easily set up in the Which50 platform with just a few clicks of the mouse and with no code required – find out more in this case study.

2. Copper-fastening Customer Convenience

Expectations of convenience, interconnectivity and real-time technological capability have accelerated rapidly amongst the mobile generation.

As a consequence of these demand-side drivers, the entire financial services sector has become more customer-centric, which traditionally has been a differentiator for local community banks. Today, technological convenience is now a basic requirement for all and automation of services like loan applications and advances like real-time account notifications have become baseline expectations and mutual banks must embrace technology to copper-fasten their claim on convenience.

3. Secure, Scalable Solutions

By their nature, community-owned banks and credit unions tend to be more conservative and risk-averse. They exist to serve their members, rather than focusing on profits for shareholders like traditional commercial banks.

As a result, they can be slower to embrace technological advancement but this cautious approach isn’t necessarily a bad thing in the long-term. When it comes to digital transformation, community banks tend to be primarily solution-oriented and member focused, whereas conventional banks are focused on return on investment. This is a crucial difference in outlook with mutual banks prioritising the interests of their members as they seek robust, progressive digital solutions that minimise disruption to members in the digital transformation journey.

Members rely on the assurance that their funds and data are secure and any new technology must therefore leverage capabilities such as multi-factor authentication, end-to-end encryption and continuous fraud monitoring. There is also an expectation that third-party partners can demonstrate a commitment to the highest cybersecurity standards.

Embedded legacy IT systems can pose a challenge for both mutual and commercial banks. Which50, as a solution has been designed to interact ‘quickly and easily’ with legacy systems via different methods including APIs, Robotics and Secure File Transfer which is a potential game changer for mutual banks facing digital transformation projects.

4. Sustainability as standard

Perhaps the best part about embracing technology and evolving the customer experience is that it doesn’t require a mammoth IT budget and member funds can be invested prudently and iteratively in the new technology – the emphasis is on doing things right with available resources.

Community banks have a track record of investing in their locality and aim to align closely with the values of their members and the commitment to reducing carbon footprint and a common environmental, social and governance (ESG) vision are best served through digital-first solutions.

For example, you can read in our recent case study how transitioning from traditional paper-based communication to a digitised member engagement platform has been instrumental in reducing the environmental footprint of one of Ireland’s largest credit unions. At the heart of their green initiative is a dedication to promoting environmental stewardship and reducing unnecessary waste which is a key goal for both the credit union and its members. By adopting the Which50 platform, the credit union has not only embraced modern and efficient communication methods but also contributed to reducing paper consumption, lessening reliance on natural resources, and lowering carbon emissions.

5. Seamless Omnichannel Service Delivery

Today’s consumer is bombarded with digital communications. The ability to provide a seamless, personalised and synchronised experience across digital, in-person and traditional communication channels is a major point of differentiation that mutual banks are uniquely positioned to serve. This consistent, low-friction service delivery bolsters customer satisfaction and loyalty, driving retention and growth of the customer base.

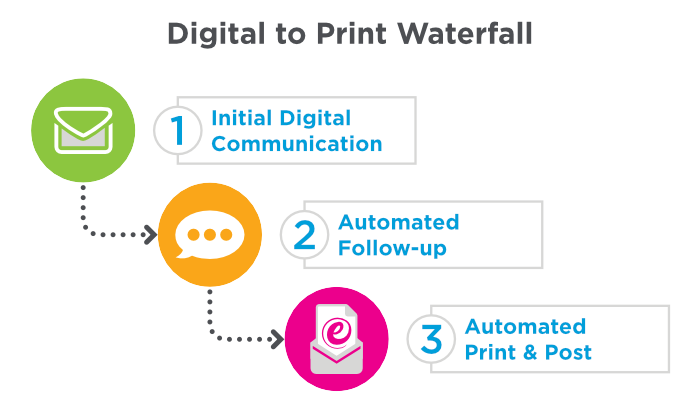

With our platform Which50, we’ve created a single pipeline to automate the communication process as all customer messaging cascades seamlessly through email, SMS and physical mail. We call it the digital-to-print waterfall – a comprehensive, synchronised communications flow that maximises the efficiency of the customer communications process while minimising disruption to the customer experience.

Conclusion

Digitalisation has sometimes been regarded as an ominous prospect for community-oriented organisations – a perceived deviation from the personalised, familiar way in which they operate.

However, digital tools can amplify that commitment to a personal customer experience and should be seen as an extension of existing capabilities, enabling a continued alignment to core values rather than a departure from the familiarity members expect.

Digital transformation has evolved from being a strategic advantage for early adopters to becoming a survival necessity and requires a deep sense of empathy which puts the customer at the heart of every innovation. Through implementation of digital communications strategies, community-owned banks can deepen relationships with their member base and lay a foundation for sustainable customer retention and responsible growth.

To learn more about the digital-to-print waterfall, customer retention management or any of the other capabilities of the Which50 platform please get in touch to arrange a conversation.

LOG IN

LOG IN