5 Digital Transformation Resolutions for Credit Unions

It’s that time of the year again when we all start making lists of the things we want to ‘work on’ in the New Year. For those working in the banking sector, digital transformation is likely to be ‘top of the list’ for 2024 so we thought we would share some thoughts with you to kick-off the year.

Digital transformation is a phrase that’s been with us since 2013 but in many ways, the digitisation of commerce has been around since the development of microchips in the 1950s – it may not have been referred to as digital transformation at the time but the beginning of automating manual processes through digital technologies is not a new phenomenon.

For large retail banks spoiled with seemingly unlimited human and financial resources, the prospect of a digital transformation project is seen as a progressive evolution of how they operate – in fact, most are probably well on their way with this journey already. For credit unions and community banks with less resources, progress on this journey can be slower and talk of digital transformation may seem a daunting distraction from day-to-day operations but this should not be the case.

In fact, an iterative approach to embracing digital transformation allows credit unions to stay competitive, enhance member experiences and streamline rather than disrupt day-to-day operations. In this article, we’ll explore five key digital transformation resolutions for credit unions, drawing on valuable insights from previous digital transformation projects undertaken with credit unions using the Which50 customer communications platform.

1. Emphasise Member-Centric Digital Experiences

One of the core principles of our approach at CustomerMinds is the importance of member-centric digital experiences – putting the customer at the heart of your transformation project. Credit unions need to understand and meet the evolving needs and expectations of their members. This involves creating user-friendly online platforms, mobile-first responsive design, and digital services that simplify transactions, account management and communication.

The importance of the digital experience has been accelerated by the COVID-19 pandemic and while banks have advanced their digital capabilities, it’s widely recognised that credit union efforts to embrace digital have been largely ‘hit and miss’.

In our series on SMART Customer Journeys, we highlight the importance of personalisation and using technology to scale personalised communication. Tailoring digital experiences based on individual member preferences fosters a sense of connection – a foundation for customer loyalty – and also increases ongoing customer engagement. This is especially important to credit unions as they tend to rely heavily on personalisation as a point of differentiation versus corporate banking institutions.

Features such as personalised offers, targeted messaging for different customer segments and intuitive interfaces contribute to a positive member experience.

You can see a great example of this member-centric approach in our case study from Life Credit Union who have customised messaging in their Welcome Journeys based on the age of the new member and their ‘life stage’.

2. Seamless Integration of Digital Platforms

Credit unions – like most commercial banks – rely on a variety of systems for different functions and ensuring seamless integration is critical for a smooth digital transformation. It is important that any digital transformation project considers the entire technology stack and aims to adopt new technologies that facilitate the integration of various digital platforms, including core banking systems, CRM solutions and third-party applications.

For example, the initial need or desired solution might address a particular operational pain point like focusing on marketing automation for your credit union, however, it’s important to take a step back and consider marketing in the context of the wider customer journey in order for your credit union to make the maximum efficiency gains from going digital.

A unified digital communication eco-system enables a holistic view of member interactions, streamlines internal processes, and reduces operational complexities. This integration also enhances data flow between different systems, providing a unified, seamless experience for both credit union staff and members.

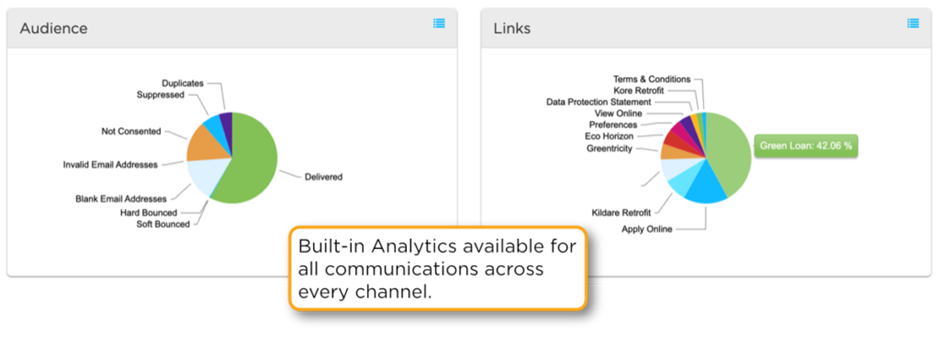

3. Implement Robust Data Analytics

“What cannot be measured cannot be improved” is a paraphrased quote attributed to physicist Lord Kelvin and its broader application is relevant here. Data is the lifeblood of digital transformation, and credit unions can leverage it to gain valuable insights into member behaviour, preferences, and trends. At CustomerMinds we advocate for the implementation of robust data analytics solutions to drive informed decision-making aimed at optimising the customer experience, driving revenue growth and customer retention.

By analysing member data, credit unions can identify patterns, predict emerging trends in customer behaviour and can then customise their offerings accordingly. This data-driven approach enables targeted marketing, risk management and the development of innovative financial products. Furthermore, data analytics can enhance data privacy and security measures, ensuring a trusted digital environment for members.

4. Foster a Culture of Innovation

Digital transformation is not just about adopting new technologies; it requires a cultural shift within the organisation. To successfully transition to a digital-first approach, there is a need for credit unions to foster a culture of innovation, encouraging employees to embrace change.

While the very mention of digital transformation heralds change and people are often resistant to change in the workplace for a number of reasons, this quote from the linked Harvard Business Review article is a pertinent motivator for embracing the positive change technology brings:

“Employees are almost always tremendously relieved when they discover just why they feel as if they are rolling a boulder up a hill only to have it roll back down again.”

This willingness to embrace change doesn’t need to be a difficult or drawn out process – when employees understand the intent of digital transformation and how it will benefit them in their day-to-day roles, they are willing to embrace change.

Depending on the size and capabilities of personnel within the organisation, this cultural shift could involve short conversations or more extensive training programs to enhance digital literacy among staff members. Additionally, credit unions should consider establishing cross-functional teams that bring together individuals from different customer facing roles – marketing, customer onboarding, customer service and customer retention – this collaborative approach involving a diversity of skills and perspectives can contribute to greater success on new digital initiatives. Creating an innovation-friendly environment empowers employees to contribute ideas, share their perspective and challenges and adapt collectively to the changing digital landscape.

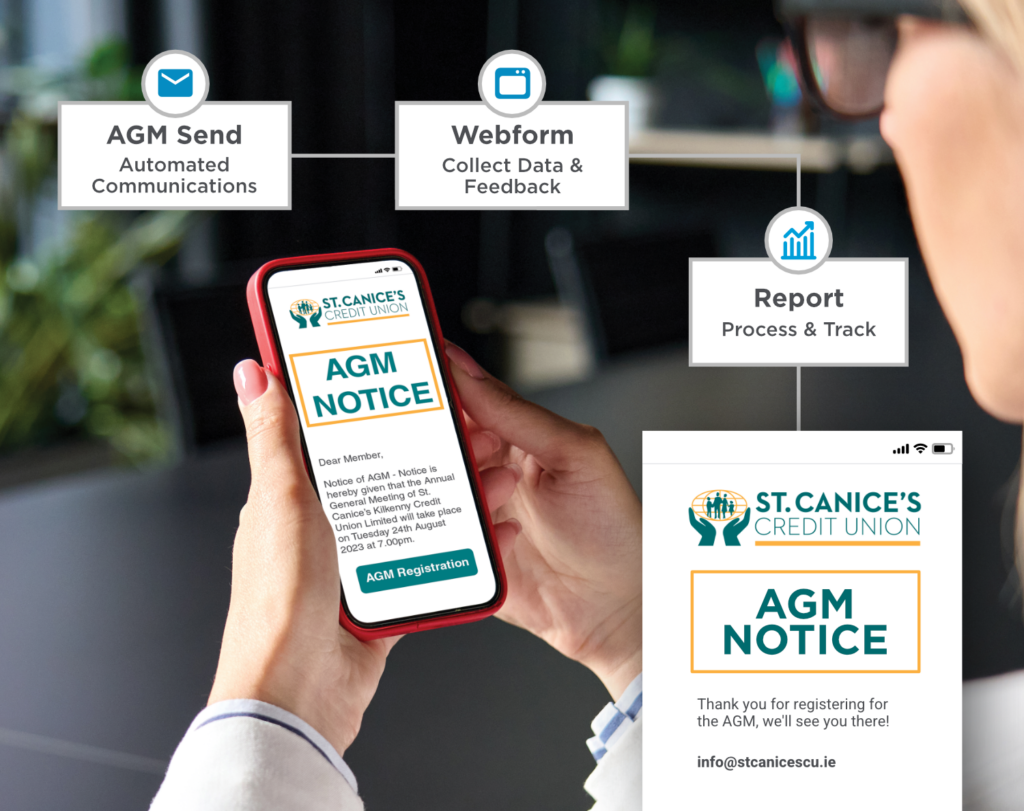

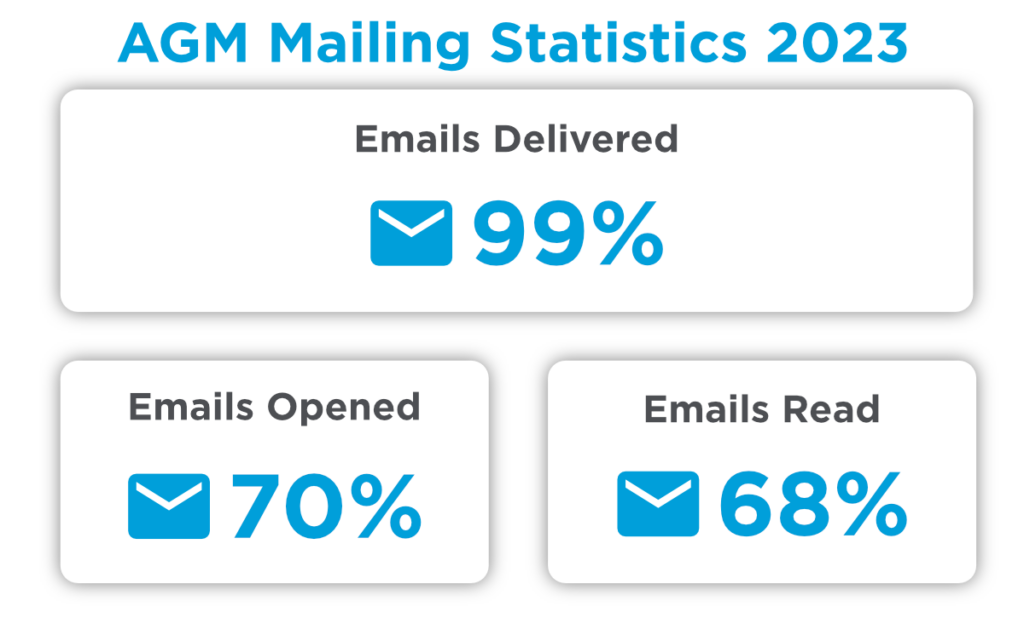

A great example of this culture of innovation can be found in our case study on St. Canices Credit Union – one of the largest credit unions in Ireland with over 65,000 members. They set up a small team as key drivers of their transformation initiative and they worked closely with the team at CustomerMinds to take over ‘self-service’ responsibility for all digital communication journeys to their members.

See case study for more details on these impressive results from their 2023 AGM Mailing

5. Prioritising Cybersecurity

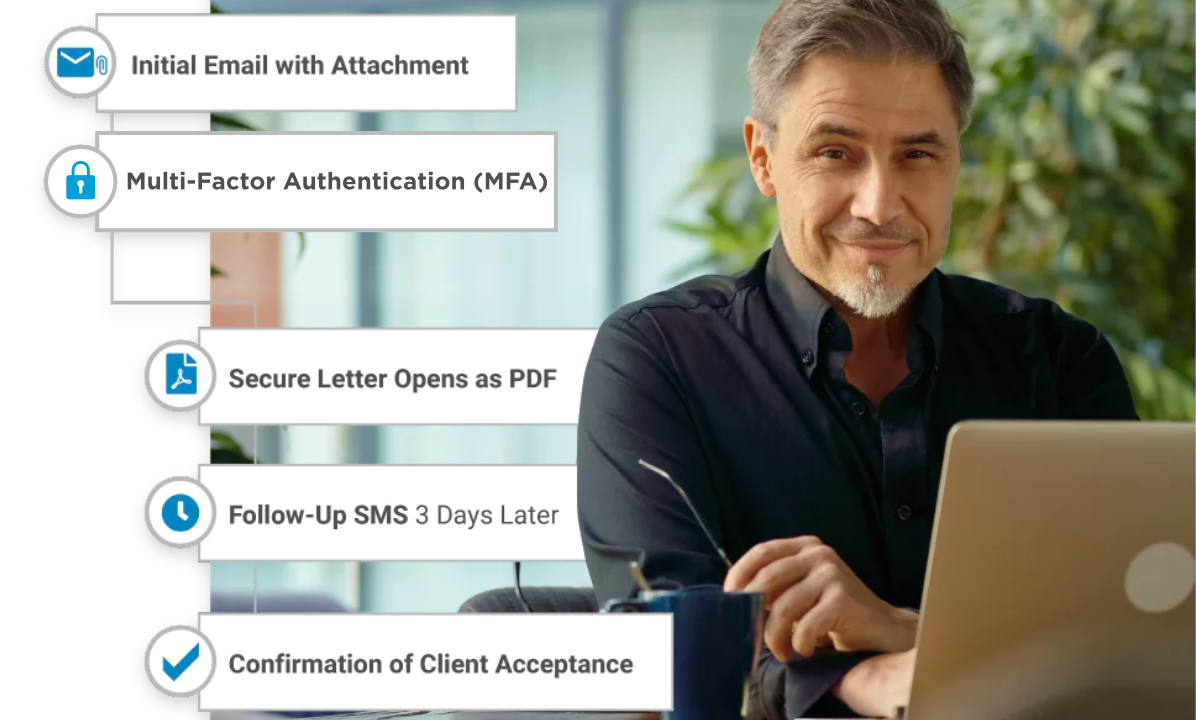

As credit unions embrace digital channels, the importance of cybersecurity cannot be overstated. The threats posed online are manifold and and multi-channel, underscoring the need for robust cybersecurity measures to safeguard member data and protect against cyber threats.

Implementing advanced encryption, multi-factor authentication and continuous monitoring are essential steps in enhancing cybersecurity. Regular training sessions for employees on cybersecurity best practices can help create a vigilant workforce. Credit unions should also stay abreast of the latest cybersecurity developments and update their systems accordingly to stay ahead of potential threats.

It is also imperative to partner with organisations that prioritise data security – at CustomerMinds, we are certified to key standards such as ISO27001, CyberEssentials and FSQS giving you the peace of mind that your customer data is secure.

Click for information on CustomerMinds ISO 27001 Certification

Conclusion

Digital transformation is ultimately a rewarding journey for credit union staff and members and the challenges and complexities should not overwhelm or interrupt day-to-day operations. When managed correctly, the transformation project should aim to minimise disruption to ‘business as usual’ – this requires a degree of strategic planning, cultural adaptation and a continuous focus on member satisfaction and data security. By following the recommendations outlined above, in partnership with an experienced digital transformation solutions provider, credit unions can navigate the digital landscape successfully to remain competitive while boosting employee job satisfaction and customer loyalty by embracing the latest available tools in an increasingly technology-driven financial sector.

To learn more about our digital customer communications platform Which50, get in touch to arrange a demo.

LOG IN

LOG IN