Targeting the Segment of One: Transforming Customer Experience with Hyper Personalisation

As the year winds down and festive cheer fills the air, it is also time to bring our SMART Customer Journeys series to its conclusion. In the previous articles in the series, we’ve explored the crucial themes of Data Security, Measurement and Analytics, Automation and Responsive Design. Now, in our final instalment, we’ll unwrap the significant roles of Targeting and Personalisation in enhancing omni-channel customer experiences, just in time for the holiday season.

In this we will examine Why Targeting Matters in service sectors, the power of Behavioural Targeting, the innovation behind Data-driven Personalisation, the adaptability of Dynamic Content, and how all these techniques can be applied at each stage of the Customer Lifecycle.

1 – Why Targeting Matters for Service Sectors?

Targeting is not just a customer experience buzzword; it’s the cornerstone of effective omnichannel customer journeys. In service sectors, such as banking, telco and utilities, customer needs can be diverse and complex, and effective targeting ensures that the right message reaches the right customer at the right time. It’s about understanding the nuances of your customers’ preferences and behaviours and tailoring your approach accordingly.

For instance, a bank or credit union might use targeting to differentiate messaging for students versus young professionals, recognising their distinct financial needs.

Similarly, a utility company could target messages about energy conservation differently to urban dwellers compared to rural customers.

2 – Behavioral Segmentation: Enhancing Engagement with Smart Retargeting

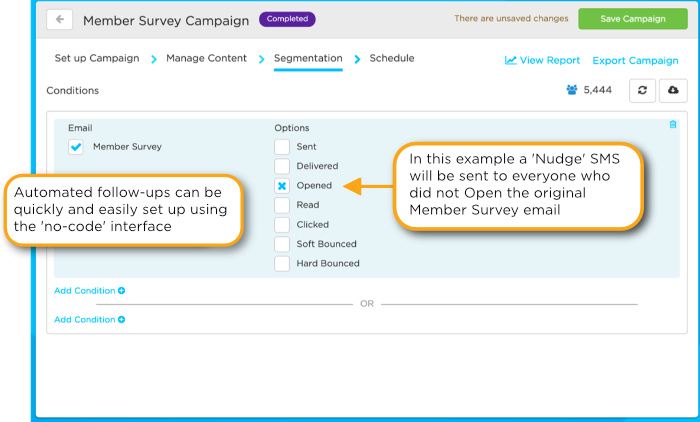

In today’s fast-paced digital environment, where customer attention spans are at a premium, having the ability to pivot and retarget through different communication channels is invaluable. It ensures that essential messages are not just sent, but are also noticed and acted upon. For instance, if a customer receives an important email but doesn’t engage with it you can automatically trigger a follow-up nudge via SMS.

More than just a tool for effective communication, this multi-channel retargeting approach is also pivotal for service providers in meeting regulatory requirements. For example, in the scenario above, if the nudge SMS still does not get a reaction from the customer then your omni-channel platform should be able to escalate the communication strategy by generating a printed letter that can be posted out to the customer. This layered approach ensures that all customers, irrespective of their preferred communication channel or digital engagement level, receive the necessary information. It’s a fail-safe mechanism that not only enhances customer engagement but also keeps service providers compliant with industry regulations.

3 – Data-Driven Personalisation

In the digital age, personalisation is the key to customer engagement. This isn’t just about addressing customers by name in emails. It’s about leveraging core system data to create a truly individualised experience.

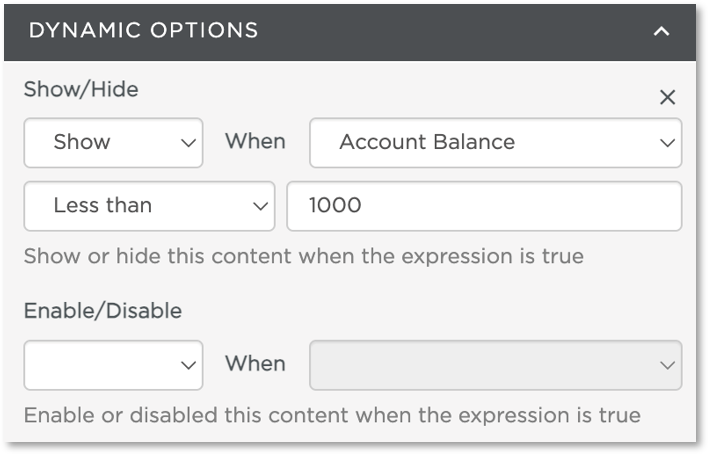

Imagine a scenario where a bank can predict a customer’s need for a home loan even before they start looking. Or a utility provider proactively offering tailored energy-saving tips based on a household’s usage patterns. This level of personalisation can transform customer experiences, and it’s all made possible by the intelligent use of data. Which50 integrates seamlessly with core systems, enabling businesses to utilise their data effectively for unprecedented levels of personalisation. In the example below certain content could be displayed only to customers whose Account Balance is less than 1,000.

4 – Dynamic Content: Elevating Engagement in Customer Journeys

In services sectors, dynamic content can play a critical role in delivering effective customer journeys that reduce cost whilst enhancing customer engagement. By harnessing a blend of dynamic graphics and conditional logic, we take personalisation beyond the expected, creating real-time, adaptable interactions that resonate with every customer’s unique journey.

Consider the experience of a customer engaging with a dynamic webform: their journey can be shaped by the data, from the core systems, transforming standard content into an experience that speaks directly to them. New visitors are welcomed with introductory graphics and text, while long-standing customers are greeted with messages that acknowledge and celebrate their loyalty. This level of personalisation not only elevates the user experience but also builds a stronger connection between the service provider and their customers.

Tailored Collections Journeys

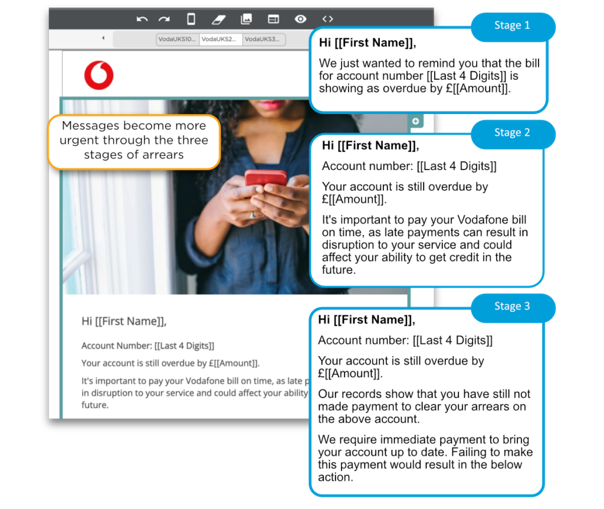

A great example of dynamic content’s impact is evident in the self-service collections journeys that we’ve developed for leading telcos such as Vodafone and O2.

Here, the content dynamically shifts to reflect the urgency appropriate for each stage of debt recovery. As shown in the example below, customers in the later stages of debt will encounter content that conveys a heightened sense of urgency, encouraging prompt action and payment resolution. By implementing these targeted, data-driven self-service journeys, there has been a significant increase in customer responsiveness and payment rates.

5 – Personalisation Across the Customer Lifecycle

Targeted personalisation can be applied at each stage of the Customer Lifecycle, from the first encounter with the customer to the establishment of long-term loyalty. By integrating sophisticated personalisation and targeting techniques, service providers can deliver bespoke experiences that resonate deeply with customers at each stage of the Customer Lifecycle. For more details, click on each of the five sections in the graphic below.

Personalisation Across the Customer Lifecycle

Click on each of the below segments to learn more on each stage of the customer lifecycle

Acquisition

The journey commences at Acquisition, where personalisation serves as a beacon, drawing in potential customers with tailor-made marketing messages and offers that strike a chord with their specific needs and desires.

Onboarding

Transitioning into the Onboarding phase, the power of targeted personalisation comes to life as customers are greeted with customised welcome packs and setup guides, fostering a sense of belonging and clarity.

Billing & Collections

During the Billing & Collections stage, personalised communication is crucial. Customers receive individualised billing information, reminders, and suggestions for payment plans that suit their usage patterns and financial preferences, thereby enhancing trust and transparency.

Servicing

At the Servicing stage, personalisation ensures that every interaction, be it through self-service portals or direct contact, is informed by the customer’s history and preferences, leading to faster resolution times and a more satisfying service experience.

Retention

Finally, in the Retention phase, the culmination of earlier targeting efforts pays dividends. Personalised retention campaigns, informed by customer behaviour and feedback, engage customers with highly relevant offers and incentives, driving loyalty and reducing churn.

Conclusion – Striving for the Segment of One

In conclusion, we believe that all service organisations must strive to achieve the ultimate goal of targeting the elusive ‘Segment of One’ and delivering hyper-personalised digital journeys to every customer. It is much easier however to state this goal than it is to achieve it – so organisations must set out a clear customer engagement strategy that is not just about sending out ‘batch and blast’ content to reach an audience but that focuses on connecting with each individual on a personal level.

This approach, forms the core of the Targeted pillar, the final element in our SMART Customer Journeys framework. By integrating this philosophy with our key themes – from understanding the benefits of behavioural segmentation to harnessing the power of data-driven personalisation, dynamic content, and service automation – we support our clients to pave the way for a more intuitive, responsive, and ultimately successful customer journey strategy. As we embrace this targeted approach, we empower our clients in banking, telecom, and utilities to not only meet but exceed the expectations of their customers, delivering experiences that are as unique as the individuals they serve. If you would like to find out more about how we can help you target the ‘Segment of One’ please fill out the form below or Follow Us on Linkedin.

To read each post in our SMART Customer Journeys series, visit the links below:

Get SMART about your Customer Journeys

S – Data SECURITY and Privacy in Customer Engagement

M – 5 Steps to MEASURABLE Success in Customer Engagement

A – Is For AUTOMATION – the Beating Heart of SMART Customer Journeys

R – 5 Key Considerations for Delivering a Mobile RESPONSIVE Experience to Customers

T – TARGETING the Segment of One: Transforming Customer Experience with Hyper Personalisation

LOG IN

LOG IN