5 Key Ways to Digitise Your Mortgage Journey

As financial institutions adapt to the digital age, one area that presents significant opportunities (and challenges!) for digitisation is the traditional mortgage journey. The coming together of new technologies and financial services offers a unique opportunity for traditional retail banks, community banks, building societies, mutual banks and credit unions to revolutionise how they interact with consumers throughout the mortgage process. Embracing this digital evolution not only promises increased operational efficiency but also unlocks the potential for enhanced customer communication and improved decision-making.

According to a survey completed by Forbes, the belief among 63% of consumers is that being able to complete the mortgage process online would make purchasing a home easier than an in-person process. There is also a competitive imperative to digitise the mortgage journey and according to a recent study from Deloitte, new fintech lenders process applications around 20% faster than “traditional lenders” according to a recent study.

In this article, we will look at five key ways that financial institutions can digitise their mortgage journeys, exploring the benefits that this transformation can bring to both lenders and borrowers alike.

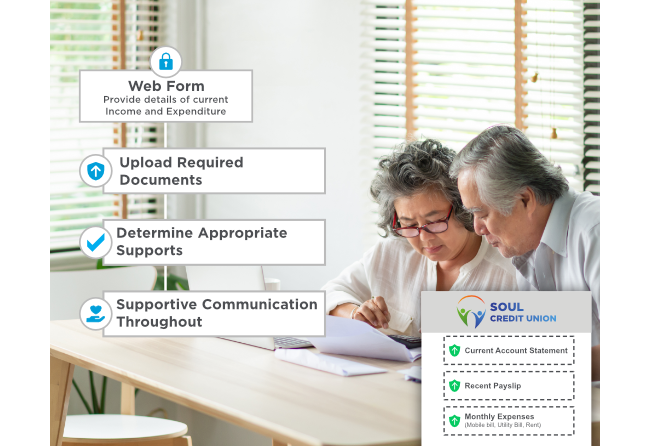

1) Digitise Income and Expenditure

Digitising the income and expenditure assessment process (often shortened to I&E) is pivotal for banks and credit unions. This digital transformation offers several advantages:

- Efficiency: Automation of income and expenditure assessments reduces manual workload, accelerates decision-making, and minimises errors.

- Data Accuracy: Digital tools can access and analyse financial data with precision, ensuring accurate assessments.

- Enhanced Customer Experience: Borrowers appreciate the speed and convenience of digital assessments, which can lead to higher customer satisfaction and loyalty.

- Compliance: Digital systems can help institutions stay compliant with evolving regulatory requirements.

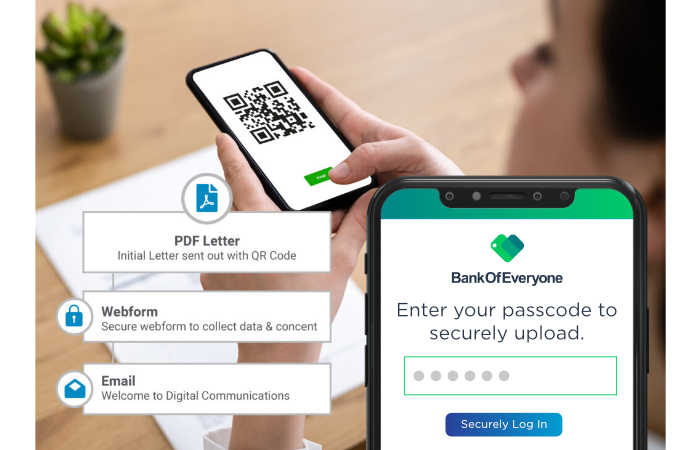

2) Digital Document Request and Upload

Making document requests and uploads digital can simplify and expedite the mortgage application process:

- Paperless Convenience: Borrowers can submit required documents electronically, eliminating the need for physical paperwork.

- Reduced Processing Times: Digital document management allows for faster verification and underwriting.

- Enhanced Security: Encryption and secure servers protect sensitive customer information.

- Audit Trail: Digitised processes create a comprehensive audit trail for transparency and compliance.

3) Digital Welcome Journeys

Digitising the welcome journey for mortgage customers can set a positive tone for their relationship with your institution:

- Personalisation: Use digital platforms to send tailored welcome messages and onboarding materials.

- Education: Provide digital resources to help customers understand their mortgage terms and responsibilities.

- Communication: Use automated notifications to keep customers informed about account activities and payments.

- Cross-Selling: Utilise data analytics to identify opportunities for cross-selling other financial products.

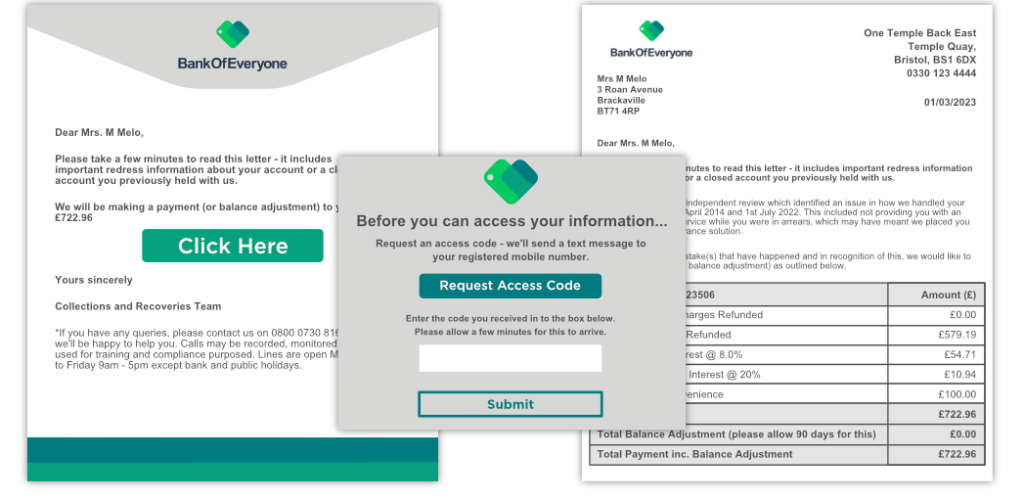

4) Digitise Remediation Process

Automating the process of sending digital versions of remediation letters can help middle-tier banks and credit unions efficiently address issues and improve customer relations:

- Timeliness: Automated systems can trigger remediation letters promptly when issues are detected.

- Consistency: Standardised templates ensure that all communications are clear and compliant.

- Tracking and Reporting: Digital systems provide robust tracking and reporting capabilities for remediation efforts.

- Cost Savings: Reduced manual intervention can result in cost savings over time.

5) Digitise Arrears and Collections Process

Digitising arrears and collections processes can mitigate risk and improve recovery rates:

- Payment Options: Offer digital payment methods and negotiation tools to facilitate customer cooperation.

- Data Analytics: Use data analytics to predict and optimise collection strategies.

- Compliance Management: Ensure that collections practices adhere to regulatory requirements through digital oversight.

Conclusion

In conclusion, digitising these key mortgage processes can empower financial institutions to operate more efficiently, reduce risks, and provide a superior customer experience. Embracing digital transformation is not just an option but a necessity in today’s financial landscape. By taking these steps, your institution can stay competitive and thrive in the digital age.

For a free consultation on digital mortgage customer journeys or to get a demo of our customer communications management software, fill in the form below and a member of our team will be in touch.

LOG IN

LOG IN