Shifting to a more Sustainable Future – St. Canice’s Credit Union

Read Now

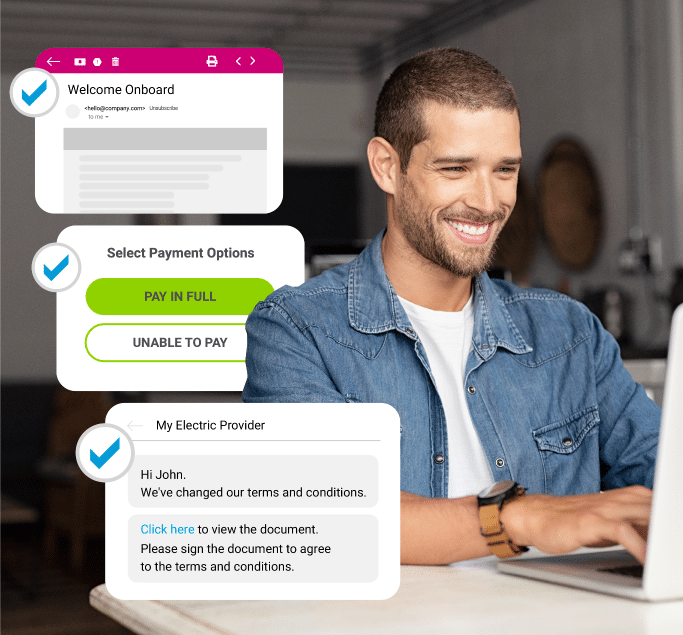

For companies in highly-regulated sectors, communicating with your customers through digital channels can be difficult. At CustomerMinds, we understand the challenges you face and our unique customer communications platform Which50 is purpose-built to meet your needs. When it comes to choosing a customer communications platform, remember Which50 allows you to significantly reduce operational costs, enhance customer experiences and meet all compliance standards through one solution.

The energy and utility sectors have never been more competitive. With green energy and eco-awareness driving customer behaviour, utility companies need to create stronger relationships than ever before at every stage on the customer journey.

Heavy regulations and a wide range of products means consumers can feel confused by financial service providers. Our customer experience platform can help credit unions, banks and building societies to automate communication processes and maintain close connections with their customers in a competitive market.

As connectivity options increase, bundling and single suppliers are very attractive to telco consumers. For providers of what are now essential services, enhanced digital onboarding solution can build a long-term bond with customers, increasing loyalty and driving customer retention.