The role of Digital in addressing the Consumer Duty

Introduction – What is the Consumer Duty?

The Financial Conduct Authority (FCA) has found 7.8 million people in the UK are finding it a heavy burden to keep up with their bills, an increase of around 2.5 million people since 2020.

It is within this challenging economic environment that the FCA is introducing the new ‘Consumer Duty’ regulation which is due to come into effect on July 31st 2023. The FCA’s objective is that the new Consumer Duty will “set higher expectations for the standard of care that firms provide to consumers.” Their goal is that consumers should receive products and services that meet their needs and offer fair value, communications they can understand and get the customer support they need when they need it.

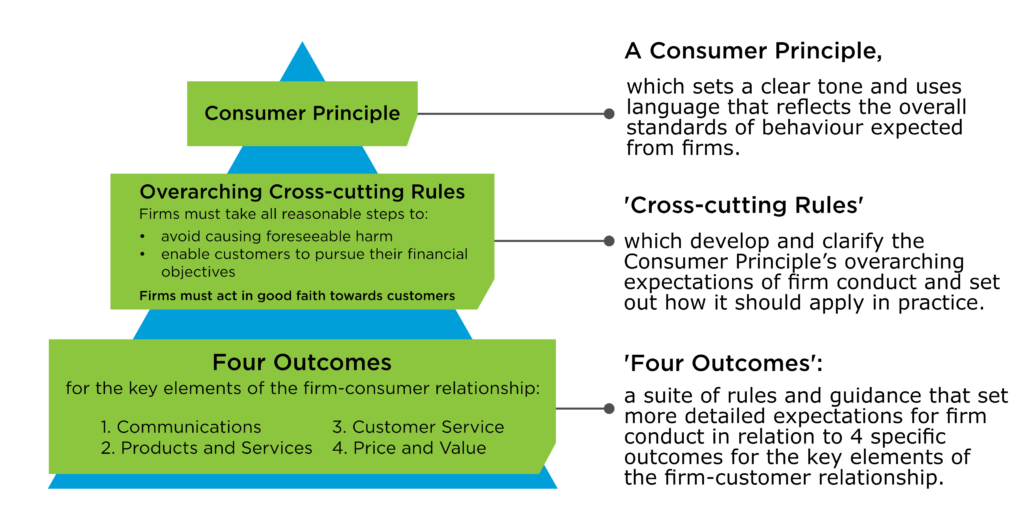

The Duty consists of three key elements (see graphic below):

- A new Consumer Principle which sets out the overall standards expected and requires firms to “act to deliver good outcomes for retail customers”

- A set of Cross-cutting rules which set out how the Duty should be applied across the firm

- Four Outcomes, which are a suite of rules and guidance setting more detailed expectations for firms.

The Consumer Duty requires firms to pay due regard to their customers’ interests and to treat each consumer fairly throughout their customer journey with the firm. Additionally, they must provide products and services that are appropriate for each customer’s needs and provide clear and accurate information to help customers make informed decisions about the financial products that they are considering.

What sectors are impacted by the Consumer Duty?

The Consumer Duty applies to all firms regulated by the FCA which includes firms in the financial services industry such as banks, insurance companies, investment firms, and financial advisers. It also applies to firms in other sectors that are regulated by the FCA, such as consumer credit firms and payment service providers. In general, any firm that provides financial products or services to consumers is impacted by the Consumer Duty.

The role of Digital in addressing the Consumer Duty

The two most obvious areas where digital technology can support the implementation of the Consumer Duty is to address the requirements of the Outcomes relating to Consumer Understanding and Support. A key over-arching theme from the FCA is that consumers must be provided with the information that they need when they need it and this level of care and attention must be provided throughout the product lifetime and not just during the acquisition and sale process.

We wrote recently about why investing in Digital Operations is a ‘win-win’ scenario for banks and in that article, we talked about the 5 Stages of the Digital Customer Lifecycle (see below) and the importance of providing the same connected digital experience to the consumer across the full customer lifecycle. In this post, we will expand on how digital technology and techniques can help address the requirements of the Consumer Duty at key stages of this customer journey.

CustomerMinds’ 5 Stages of the Digital Customer Lifecycle

Click on each segment of the graphic below for illustrative examples of digital journeys from each stage.

Digital Communication Solutions

Acquisition & Onboarding

- New Customer SignUp

- New Product SignUp

- Document Upload

- Welcome Journeys

Billing & Payments

- Payment Journeys

- Switch to eBilling

- Deliver eBills

- Direct Debit SignUp

Debt & Collections

- Payment Journey

- Promise to Pay

- Payment Arrangement

- I&E Assessment

- NOSIA Letters

Customer Service

- Bereavement

- Complaints Management

- Secure eDocuments

- Regulatory Communications

- Bulk Mail Digitisation

Retention & Growth

- Rewards

- Surveys

- Renewals

- Upsell

Acquisition and Onboarding

- Customers can be offered a trustworthy and engaging introduction to the product/service with a seamless digital experience from the start.

- Which50 allows you develop engaging webforms, giving consumers confidence to submit their details with real peace-of-mind.

- No-Code technology provides ‘multi-view’ options within the sign-up pages to that additional information such as Terms & Conditions, FAQs or informational videos can be embedded directly within the sign-up pages without the need for any programming or technical input.

- Built-in consent management features support clear and effective display of consent messages to the consumer and the collection of all permissions and preferences in centralised consent records to address any future audit requirements.

Click for more info on our Customer Acquisition Platform

Onboarding and Welcome Journeys

- Automated Welcome Journeys are key to offering new customers a safe, secure, and hassle-free introduction to a particular financial service or product, giving the consumer a digitised customer experience that puts their needs first every time.

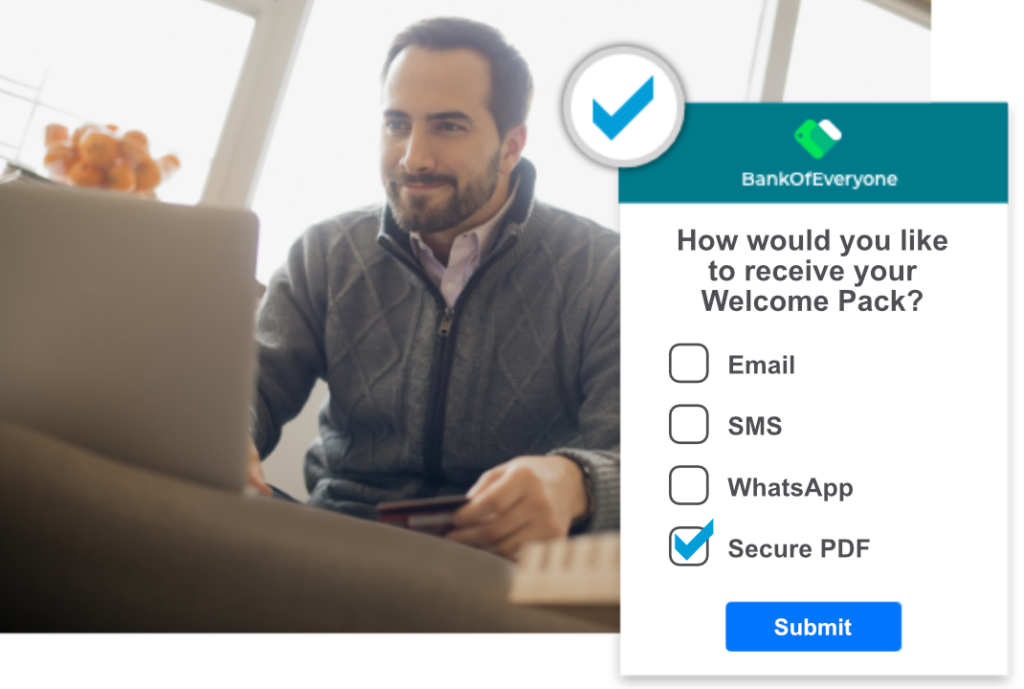

- By using multiple digital communications tools, you can talk to customers on their terms. As part of the on-boarding process, Which50 can identify the type of communications that suits the customer best, whether that be Email, SMS, WhatsApp or secure eDocuments. This ensures higher engagement and a closer customer connection going forward.

Click for more info on our Digital Customer Onboarding Solution

Complaint Management

- Complaint Management is a key area of focus within the Consumer Duty and for complaints teams the requirement to keep customers in the loop during a complaints process can be time-consuming and admin-heavy. By providing customers with a digitised complaint management experience it is possible to deliver a solution that puts their needs first and increases efficiencies for internal teams.

- The Which50 Complaint Management solution can support different digital and print communications that are automated and sent out at key stages as the complaints team work through the issue with the customer. Which50 can schedule and activate communications after pre-defined periods, like 14 days, 4 weeks, or 8 weeks, to comply with regulatory requirements.

Click for more info on our Complaint Management journeys

Collections and Arrears

- Supporting vulnerable customers in a professional and supportive manner is a crucial requirement for the Consumer Duty. The Which50 Collections Portal can offer different payment options based on existing rules and processes, delivered in collaborative ’self-serve’ journeys.

- The FCA is keen that firms utilise pre-emptive strategies to support customers in arrears as early as possible, giving them appropriate options to address outstanding bills or overdue payments. Offering digital variations for each collections or arrears journey gives customers the option to avoid awkward and stressful phone conversations by being able to resolve their arrears via a quick and collaborative digital customer engagement.

Click for more info on our Collections and Arrears journeys

Retention

- The FCA has mandated that firms must provide evidence that they are listening to their customers and one way to do that is via online surveys. Surveys can be quickly and easily set up within Which50 to ask customers what they think of a particular product or service offering – firms can show customers that they care and are willing to listen to feedback and improve.

- “In-life” communication journeys can be provided to keep customers informed on any changes to terms and conditions, rates or other product-related changes. Tips and tricks can be shared with customers to help them manage their financial affairs – particularly in times of economic uncertainty and challenge.

Click for more info on our Retention Management journeys

Conclusion – The time is right for the Consumer Duty

During these challenging economic times, we feel that all service providers owe a duty of care to their customers and therefore the rollout of the Consumer Duty by the FCA has come at a particularly opportune time for the financial services sector. Firms are now being mandated to provide the required care and service to all of the customers and to tailor their communication and support to address their different needs and circumstances. We also believe that the FCA and therefore the whole financial services sector are taking the lead on this consumer-centric approach and that there will be a lot for other service sectors to learn from the Consumer Duty experience.

The key technologies required to provide digital communications to support the Consumer Duty are now readily available and sufficiently mature for enterprise implementation. What is required is a three-way partnership between the regulator, the firm and their supplier ecosystem to deliver on the initial objectives of the regulations by July 2023 and to then continue to work together to enhance the customer experience over time to drive the required ‘customer first’ culture that the FCA requires.

If you would like to find out how the Which50 customer experience management (CXM) platform can transform your customer journey management so that you can get closer to your customers please fill out the form below and you will receive our monthly newsletter.

If you would like to learn more about the new Consumer Duty rules, you should check out our brand new podcast, ‘Which50 Works’. In our first episode, CustomerMinds Co-founder & CEO Jonny Parkes discusses the UK’s new Consumer Duty rules with Managing Partner at Bridgeforce, Adam Thornber. Click here or listen below. Don’t forget to like, share and subscribe.

LOG IN

LOG IN