New Sheriff in town for the BNPL sector

It looks as though a new sheriff may soon be riding into town for the Buy Now Pay Later sector as regulators around the globe look at ways to regulate the sector which has garnered a reputation for being somewhat of the ‘Wild West’ of the financial sector. The major players in the sector will claim that this ‘cowboy reputation’ is unwarranted and that there are benefits to providing more flexible payment options to consumers – particularly during the current cost of living crisis.

Buy Now Pay Later (BNPL) has become increasingly popular in recent years, offering consumers a way to spread the cost of purchases over time without incurring immediate expenses. The BNPL sector has grown significantly, with major players such as Afterpay, Klarna, and PayPal offering their services to millions of customers worldwide. However, with this growth has come controversy surrounding the need for regulation of the industry. In this article, we will explore the arguments for and against BNPL regulation and consider global perspectives on the issue.

What is BNPL?

BNPL is the newest payment method that people use to pay for anything from concert tickets to electricity bills, clothes and other personal items by way of borrowing small amounts of money for a short time. The reason for its popularity since its inception has been just how easy it is for people to use and the promise of low or no interest loans.

| Pros of BNPL | Cons of BNPL |

|---|---|

| – Convenient way to purchase goods – often available at point of purchase | – Difficult for consumers to keep track of all of their BNPL payments. |

| – Fast approvals with good credit scores not needed for qualification | – Despite the lack of credit checks, late payments can damage credit scores and incur fees. |

| – If paid back on time, BNPL loans can come with zero interest or lower interest than your average credit card. | – Customers may have to continue with BNPL payments even after returning an item. |

| – Consumers can better manage their cash flow by allowing them to pay for purchases in instalments. | – People can fall behind on rent or utility bills having to pay off BNPL debt. |

However, there are many charities and consumer groups that have been calling for greater control over the sector. For example, the UK consumer group “Which?” has been calling for better affordability checks after they found families and those who are facing financially challenging times are more likely to use BNPL services and many BNPL users do not think they’re taking on debt when deciding to pay later at the checkout.

What are the regulatory changes for BNPL?

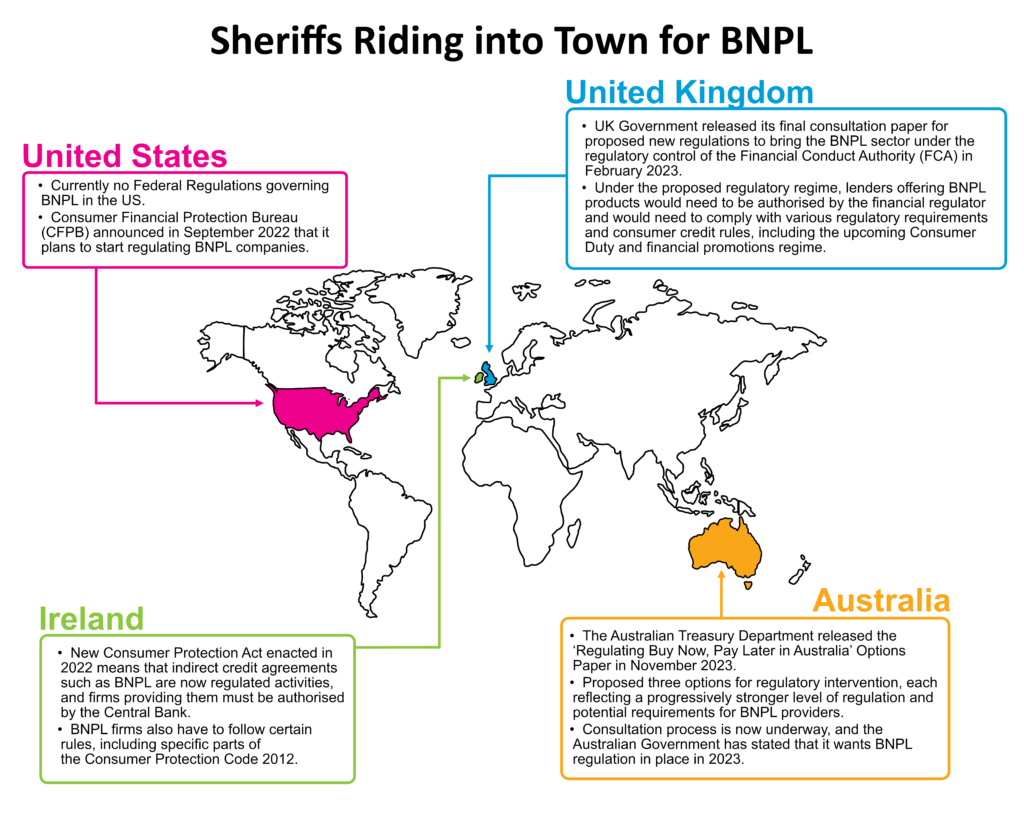

The move from the historical “Wild West” of BNPL to a more trusted system, with all providers operating by the new rules in town, is something to be welcomed by both consumers and the industry. Regulators around the globe are looking to act quickly by introducing licensing of operators, mandatory requirements for affordability assessments and controls on marketing and customer communications – see the graphic below for examples from a number of different markets.

However, according to Forbes “the current regulatory scrutiny is likely to have only a minimal effect on major BNPL firms’ operations or lending practices. In fact, it could actually help BNPL to grow further—and grow up—by curbing practices of some marginal players and creating a sense among consumers that it’s a safe, regulated business”.

To echo that positive sentiment, some of the key players in the sector have welcomed the new regulations with Philip Belamant, CEO and Co-Founder of Zilch, underlining the importance of the industry being ‘subject to the high regulatory standards of the rest of the payment space’ in a conversation with Payment Expert: “As a payments technology firm that was one of the first providers of credit via Buy Now Pay Later (BNPL) to be regulated in the UK by the FCA back in April 2020, Zilch welcomes today’s proposals set out by HM Treasury to increase regulation in the sector – we have long called for the entire industry to be subject to the same high regulatory standards that we already provide to our millions of customers. A lot of firms have paid regulation lip service but have yet to act – that’s about to change.”

Similarly the global payments giant PayPal has confirmed that it wants BNPL loans subjected to consumer protection law in its submission to the Australian government’s consultation process, adding a powerful voice from inside the sector calling for regulation.

5 Digital Capabilities that can support BNPL

If the incoming regulations are to be a positive development for those who use BNPL, providers will have to provide the appropriate support for customers and we believe that there are a number of core digital principles that have to underpin any BNPL offering regardless of whether the provider is a traditional financial services firm or a disruptive fintech:

1. Act Responsibly and Communicate Clearly

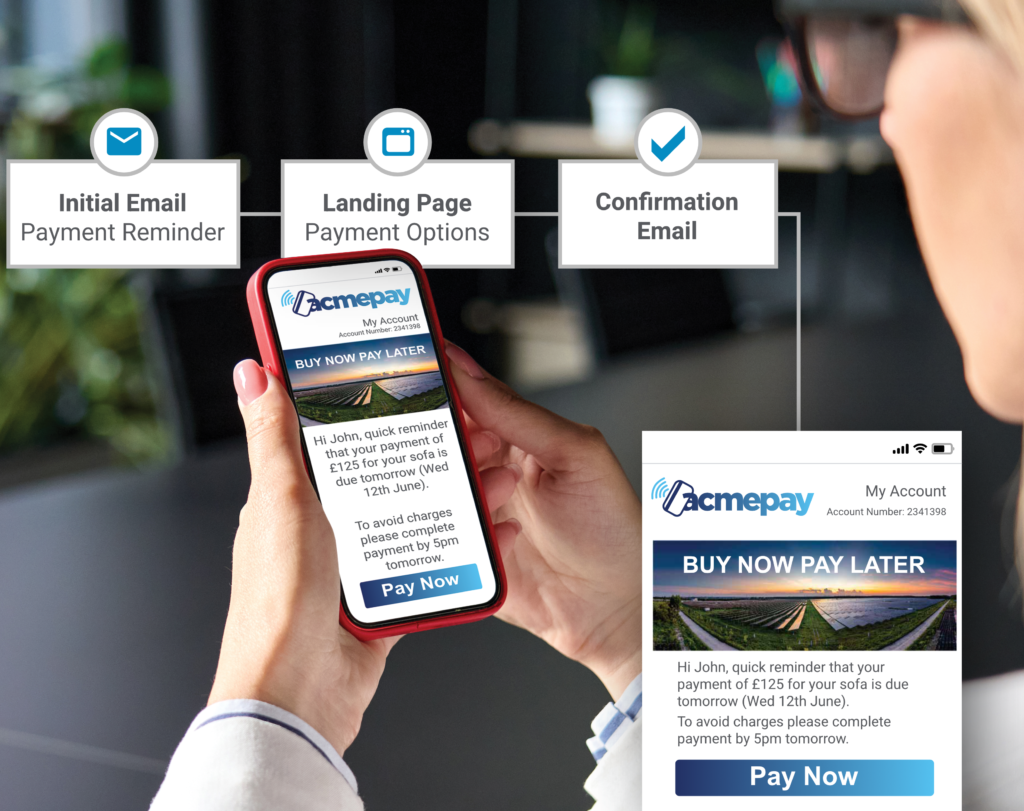

In order to change the headlines, all providers need to start acting and positioning themselves as trusted and responsible financers. Transparency and clear communication are key to building trust with customers in the BNPL sector. BNPL providers need to be proactive in communicating with customers and providing them with clear, concise information about their agreements and payment obligations. This can include sending regular updates on interest rate changes, fees, and other important information. Notifications can also be sent to customers to warn them if fees are going to be applied and to give them time to address the issue to avoid excessive charges.

2. Personalise Communications to Enhance Trust and Build Loyalty

All communications can be personalised to the individual consumer based on the specific data that is available to the provider which will help to develop a long-term trusted relationship. Personalised communications can help tailor the BNPL experience to the individual needs and preferences of each customer. For example, by analysing a customer’s purchasing history and preferences, BNPL providers can offer targeted promotions and recommendations that are more likely to resonate with that customer.

3. Assess Affordability

With the incoming regulations, good practice for providers will mean that more stringent financial assessments will have to be carried out for those that wish to avail of Buy Now Pay Later solutions. A digital–first approach can save time and resources needed to deliver an Income and Expenditure assessment that meets regulatory requirements and streamlines the customer experience at the same time.

4. Support Vulnerable Customers

It is clear that all of the regulators are particularly focused on how the BNPL sector manages its engagement with vulnerable customers and we have written in a recent post about the digital supports that can be provided for vulnerable customers. Once the BNPL firms come under the auspices of the core regulators, some of them will have to ‘up their game’ in terms of the particular supports and information that they provide to these customers – particularly as this cohort of customers may be more inclined to avail of BNPL offerings.

In the UK for example, once the FCA is in charge, the BNPL providers will need to adhere to the additional requirements of the ‘Consumer Duty’ regulation which is due to come into effect on July 31st 2023. The goal of the Consumer Duty is that consumers:

- receive financial products and services that meet their needs and offer fair value,

- receive communications they can understand, and

- get the customer support they need when they need it.

You can find out more about the Consumer Duty and how it will affect financial services in our recent blog, ‘The role of Digital in addressing the Consumer Duty.’

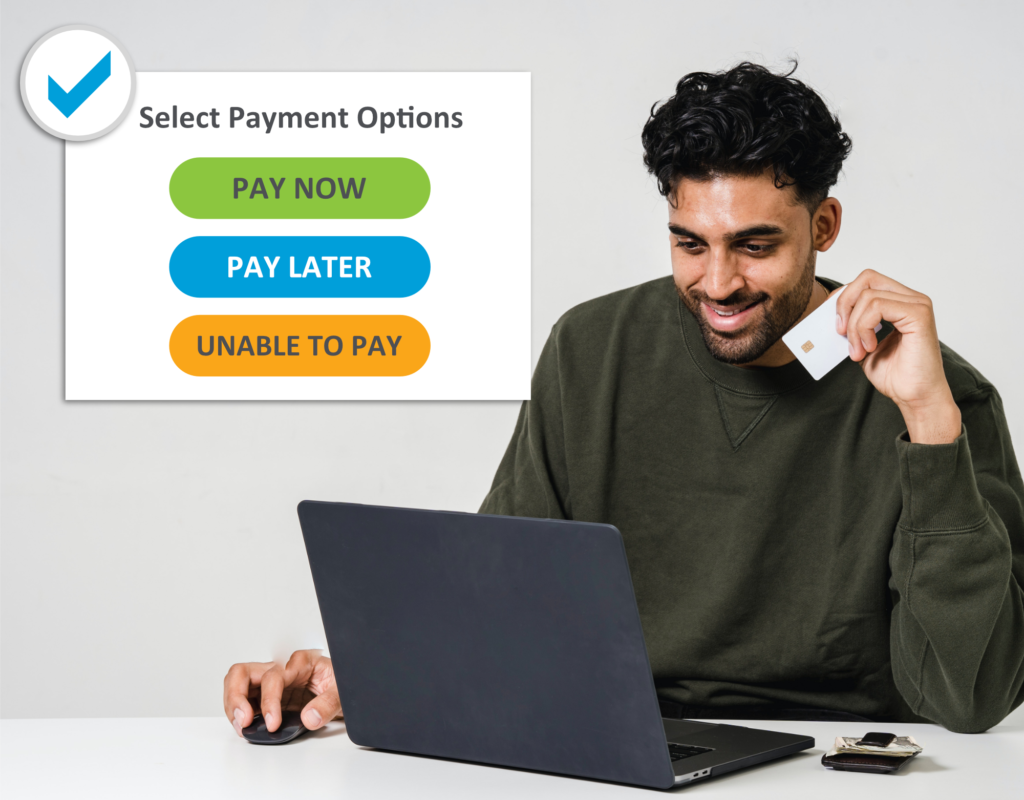

5. Manage Collections

As with any form of credit provision, it is inevitable that a certain proportion of customers will find themselves in a situation where they cannot afford to make the payments that are due. Providers must be able to provide a range of supportive processes for Collections and Arrears to engage sensitively and effectively with those customers to encourage payment where possible. Digital self-serve journeys for collections have proven to be less stressful and awkward for customers which typically results in a higher overall rate of collections.

Conclusion – BNPL done correctly can be a good thing

In conclusion, while the BNPL sector may have once been the Wild West of finance, it’s clear that regulation is now necessary to protect consumers and ensure a level playing field for all providers. The regulators may not be wearing cowboy hats and spurs, but they’re here to bring order to the industry and ensure that consumers can benefit from the convenience and flexibility of BNPL without sacrificing their financial wellbeing. For BNPL providers and traditional financial services firms alike, the challenge will be to adapt to this new regulatory landscape and find ways to thrive in a changing market.

At CustomerMinds, we believe that engaging digital journeys can play a key role in taming the Wild West of BNPL and supporting both the pioneers and traditional players as they explore the opportunities in this new world of digital finance. By leveraging digital technology and data analytics, BNPL providers and traditional banks can offer personalised and convenient services to their customers. As the BNPL sector continues to grow and evolve, it is important for all players to prioritise customer experience and stay ahead of the curve.

If you would like to find out how the Which50 platform can help digitise your customer experience, please fill out the form below to receive our monthly newsletter or contact us for more information.

LOG IN

LOG IN