Why investing in Digital Operations is a ‘win-win’ scenario for banks

Investments in digital innovation can cut costs and enhance CX at the same time

According to a recent blog post from Accenture, some banks have already cut operating costs by as much as 40 percent in key areas by switching to what they call intelligent operations. Key to this shift is the recognition that investments in digital innovation that focus on the operational or servicing side of the bank’s internal processes can lead to dramatic improvements in the banking customer experience. Leading banks, especially in Europe, have been quick to spot the potential of intelligent operations to remove the delays customers can encounter when dealing with operational teams and processes. The research carried out by Accenture shows that intelligent operations can simultaneously enhance the customer experience and the bottom line for banks and other financial institutions (e.g. credit unions, building societies) – here are some examples that clearly illustrate this ‘win-win’ opportunity:

- Time to approve mortgages reduced by up to 80 percent.

- Time to open accounts cut by nearly 70 percent.

- Customer acquisition rates improved by close to 40 percent

1 – Enhance Banking Customer Experience

“We see our customers as invited guests to a party, and we are the hosts. It’s our job every day to make every important aspect of the customer experience a little bit better.” — Jeff Bezos, Executive Chairman of Amazon.

When looking at the Customer Experience (CX) in a banking scenario, possibly the most critical elements to consider relate to the operational services banks and credit unions provide to the customer. CX is a wide-ranging term that doesn’t simply refer to marketing but encompasses every aspect of a customer’s engagement with a business or brand – one bad experience on a call with an agent can have a dramatic negative affect on the customer. In order for successful transformation to occur, all elements of the workplace need to be centred on the goal of enhancing the experience of the customer. Digital transformation is now a necessity rather than just an option due to the constant shift in customer expectation and banks must realise that their customer experience is about much more than front-end marketing technology and digital must be ‘baked-in’ in right across the bank’s operations.

2 – Improve Financial Services Operational Efficiencies

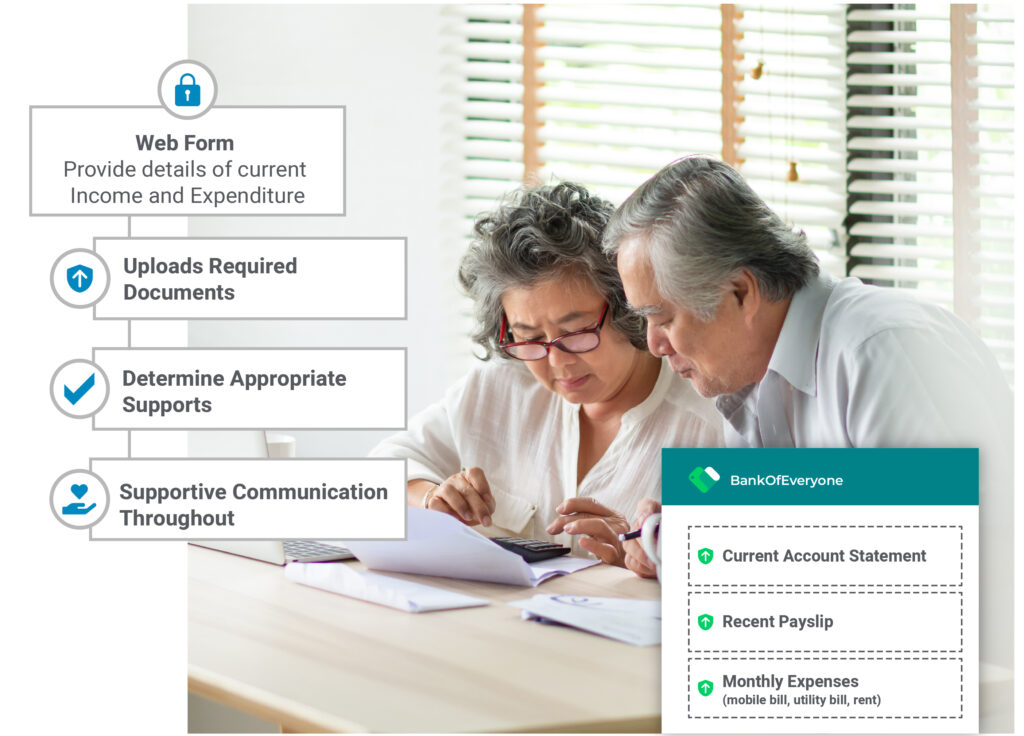

So whilst customers may think that their banking experience has been improved by the slick new app on their phone, it’s often the servicing teams working away in the background that are required to keep everything run smoothly and effectively. In a previous blog post we wrote about how Deloitte refer to this ‘Mid-Office’ within an organisation being the ‘final frontier’ of digital transformation. We discussed the important but less visible customer journeys which are often ‘left behind’ by the big budget transformation projects – these often-neglected areas include processes to support Customer Onboarding, Billing & Collections, Income & Expenditure, Complaints, Customer Service and Bereavements.

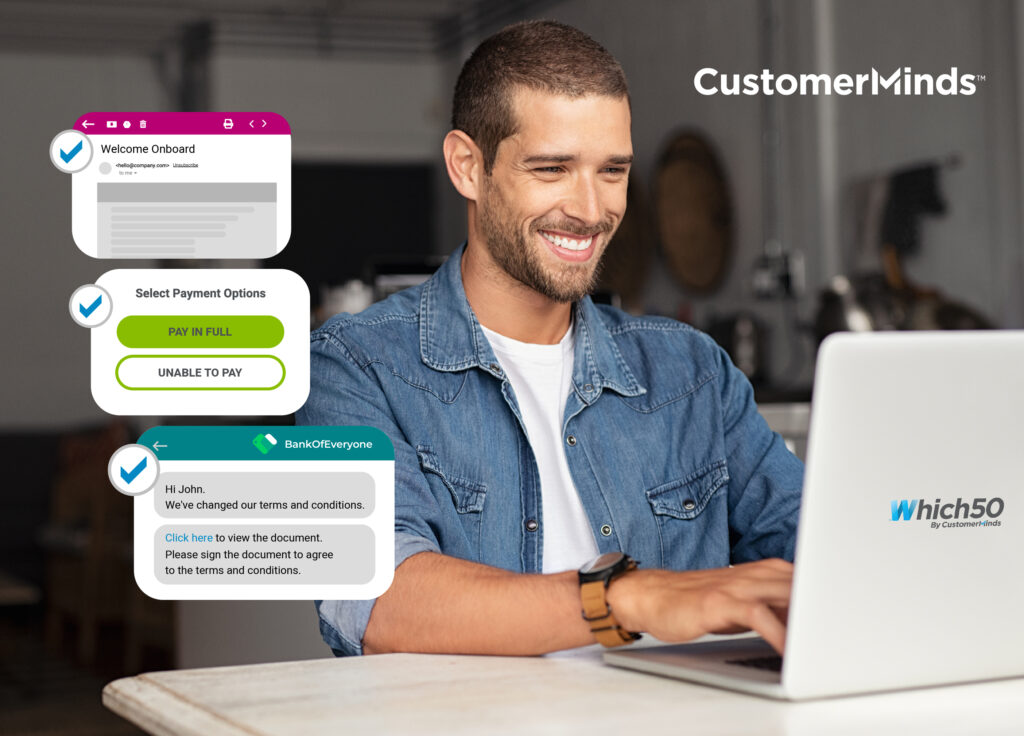

Flexible digital solutions can be quickly and easily rolled out using a customer communication platform such as Which50 that bring together the key digital components required to communicate digitally with the customer and provide the self-service portal that can securely accept the documents and data uploaded by the customer and route the query/case to the appropriate servicing team.

These are typically the everyday problems that banking customers want solved digitally but are not necessarily the functions receiving the investment and support required within the business. Instead, digital investment tends to focus on the front-office services packaged in new mobile Apps, slick user platforms, AI Bots, etc.

3 – Business Transformation

While everyone talks about how robotics, automation and digitisation will transform the way that we bank in the future, there has been less talk about what banks can be doing today to take steps towards that future. Luckily, banks do seem to be getting the message however with many organisations declaring digital operations to be a key focus for the next couple of years. In fact, of the prominent trends identified in the Accenture Banking Top 10 Trends for 2022, intelligent operations is ranked as the most influential trend and some of the most well-known banking organisations in Europe are moving in the right direction with planned overhauls of system operations, processes and procedures. If these key functions are streamlined and if intelligent digital technologies such as the Which50 platform are introduced to support their workforces, efficiency is set to increase tenfold.

Banking Case Study – DocUpload and DocRequest

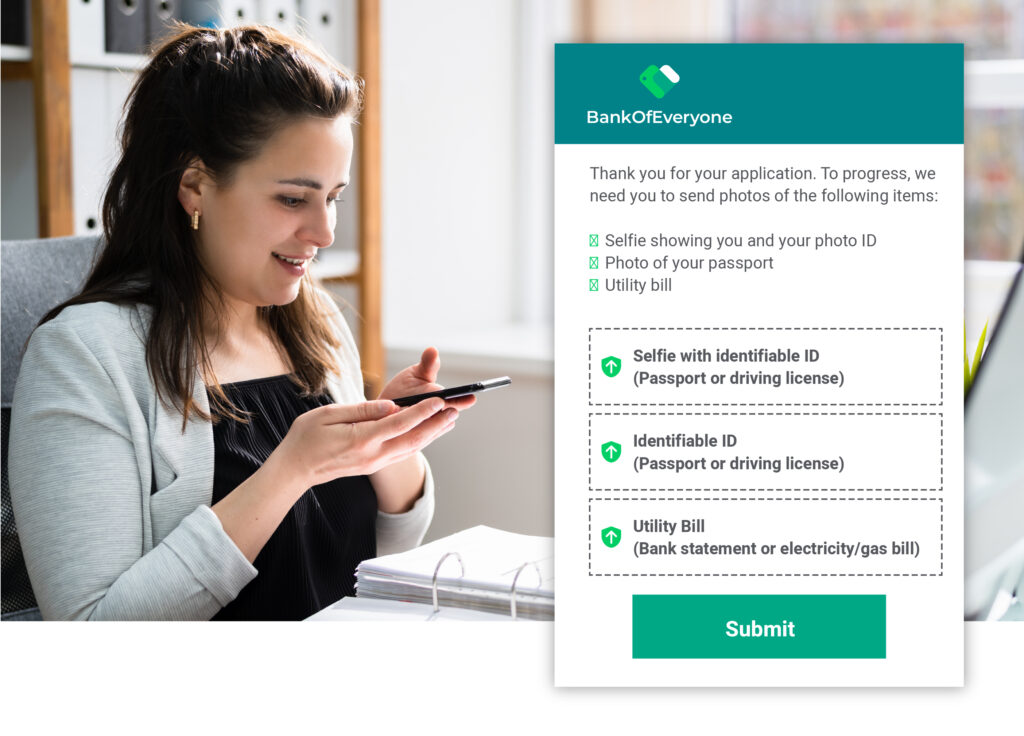

At CustomerMinds, we can share a great example of a collaborative project that we recently completed with a major retail bank in the UK – the initial challenge and ideas were driven from within the business with the critical inputs coming directly from the servicing teams. Throughout the business, they had a reliance on customers and brokers posting documents as part of an onboarding or servicing process. This often caused delays whilst the team waited for documents to arrive and sometimes they would have to request the document several times if there was an issue, waiting for the post each time.

During the height of the Covid pandemic, CustomerMinds had rolled out a self-service DocUpload application that enabled customers to upload documents securely via their phone or PC. The solution was delivered via a secure web-application that would run on any browser which meant that the solution could be rolled out quickly and easily without any need for the release of a new mobile application.

Every customer received a unique link to the portal and accessed the DocUpload page via via a secure Multi-Factor Authentication (MFA) ‘gate’ that required a One-Time Passcode that was sent out by SMS.

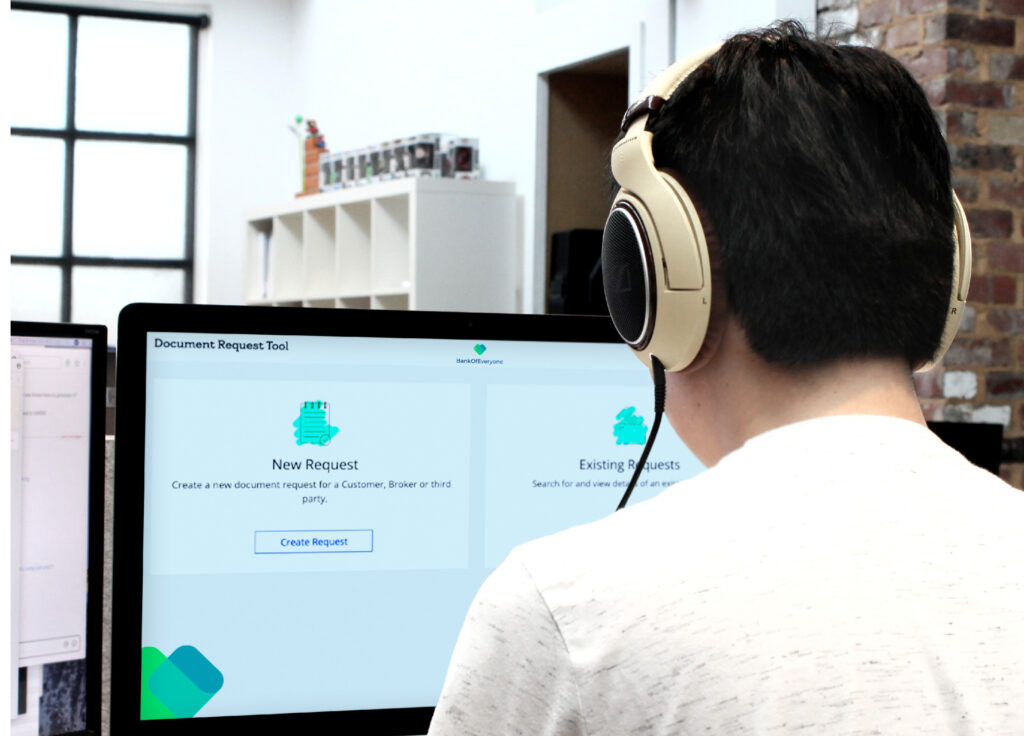

The key extension in this new project was to ‘layer on’ the agent portal that would allow servicing teams and agents to set up a personalised ‘Document Request’ email whilst they were working on a case with a customer. Through a simple interface the agent could request the required documents and a pre-prepared email would then be sent to the customer with personalised links to the DocUpload application.

Obviously the bank also wanted to maintain optimum levels of compliance, data privacy and IT security in keeping with current regulatory requirements and internal policies. In addressing these business challenges and more, the bank was able to reduce the time to process new applications from weeks to hours whilst at the same time offering new prospective customers an efficient and easy-to-use digital experience. Analytics are provided to the bank in real-time which allows them to monitor all of the ‘document traffic’ and learn from and develop better processes and communications for its customers going forward.

The great thing from a delivery perspective is that all of the key mechanics for this multi-channel journey are available ‘out of the box’ in the Which50 platform so the project was delivered in a true agile fashion in a fraction of the time it would have taken for a typical development project.

4 – Creating an Effective Digital Customer Lifecycle

The key element for the solution described above was the integration of the various different customer communication elements within the digital journey and workflow. Delivering high-quality digital customer journeys is essential as consumers connect with their financial services providers across each stage of the customer lifecycle. So at CustomerMinds we like to talk about the 5 Stages of the Customer Lifecycle – with each stage being equally critical if you want to offer your customer a true ‘end-to-end’ digital customer experience.

CustomerMinds’ 5 Stages of the Digital Customer Lifecycle

Click on each segment of the graphic below for illustrative examples of digital journeys from each stage.

Digital Communication Solutions

Acquisition & Onboarding

- New Customer SignUp

- New Product SignUp

- Document Upload

- Welcome Journeys

Billing & Payments

- Payment Journeys

- Switch to eBilling

- Deliver eBills

- Direct Debit SignUp

Debt & Collections

- Payment Journey

- Promise to Pay

- Payment Arrangement

- I&E Assessment

- NOSIA Letters

Customer Service

- Bereavement

- Complaints Management

- Secure eDocuments

- Regulatory Communications

- Bulk Mail Digitisation

Retention & Growth

- Rewards

- Surveys

- Renewals

- Upsell

Financial Services firms including credit unions, mutual banks, community banks and traditional retail banks need a digital customer on-boarding solution that works for both the institution and the customer. Using Which50, a customer’s experience can be digitised at every stage of their journey, including that all-important on-boarding phase. For banks, this means happy new customers and reduced churn, as well as lower operational costs and increased efficiency.

eBilling is essential in an increasingly digital and environmentally-aware world as most customers no longer want to get bills or statements in the post. And when it comes to payments, they expect to pay quickly and easily through digital channels. Which50 can help banks and credit unions to digitise these twin processes – with ease.

Leveraging the flexible automation capabilities of Which50, banks can set up self-service collections journeys that enable them to engage sensitively and effectively with their customers to encourage payment where possible. This will increase the chances of payment by giving the customer a better digital experience while also enhancing internal operations.

Customers often need to be kept up to date on important consumer and industry developments. Using Which50, banks can replace traditional letters with digital communications, making life easier for customers and ensuring that operational costs-per-correspondence are dramatically cut – and no more paper means a commitment to the environment too which can help to boost ESG credentials.

Banks need a customer retention solution that helps to build lasting connections with customers, giving them great reasons to stick around given that customer churn is at an all-time high in the financial sector. From running rewards programmes to customer satisfaction surveys, it is important to understand what customers want in a financial service provider. Using the Which50 platform, banks can get that capability and gain one central source of information on all customer communications campaigns and strategy from onboarding to renewal – the complete Customer Lifecycle.

Conclusion – A Win-Win-Win scenario for the Customer, the Bank and the Environment

In order to meet customer expectations in highly regulated sectors such as banking, you need a digital customer engagement platform that is agile and flexible enough to handle multiple communications channels in a secure and compliant manner. By working with the internal servicing teams ‘at the coalface’ it is possible to design and deliver innovation digital solutions that address the issues facing both the customer and internal staff. This new way of working collaboratively can help all parties ‘go digital’ and deliver on the ‘win-win-win’ scenario of a great customer experience that can also reduce costs and carbon footprint at the same time.

If you work in the financial services sector – whether it’s with a credit union, bank (retail, mutual, community-owned) or building society – and would like to find out how the Which50 customer experience management (CXM) software platform can transform customer journeys and bridge the gap in your digital transformation project, so that you can act quickly to get closer to your customers please fill out the form below and you will receive our monthly newsletter.

LOG IN

LOG IN